What had begun as a trickle from the top – with the major London auction houses increasing their timed online sales as they moved up the value chain, accompanied by a small number of specialist regional players – has turned into a steady stream this year with more mid-size and smaller firms joining in.

The range of items sold in timed sales has widened and the price point ceiling is rising (see timeline).

Although recent lockdowns have undoubtedly played a part in accelerating this shift to timed sales, none of the auction houses contacted by ATG suggested they would be reversing this trend when coronavirus is no longer a factor.

Timed is now very much of the essence.

At the very top, both Christie’s and Sotheby’s have more than doubled the number of timed sales they hold year-on-year. In 2019 Christie’s held 83. This year it will hold 196, accounting for 60% of all its auctions.

Sotheby’s has gone even further: it expects to have held about 540 timed auctions by the end of this year, up from 149 last year. These sales are attracting a new generation of bidders. About 40% of buyers in Sotheby’s online sales this year are new to the firm and almost a third are aged under 40.

Of course, by value live sales still dwarf timed at almost every auction house, but the cut-off point is changing.

By the end of September 2020 Sotheby’s had hammered down $338 million worth of items in 248 timed sales year to date (averaging $1.36 million per auction), compared with $50 million in 85 sales ($588,000 per auction) during the same period of the previous year.

In June, the firm achieved a new high for a lot selling in one of its timed sales: £2.295 million for The Bay of Naples, an oil on canvas by Ivan Aivazovsky dated 1878.

In the same month Christie’s sold a 28.86ct diamond ring for a premium-inclusive $2.115 million.

And where the biggest players lead, the others are following.

A diamond of 28.86cts, D color, VVS1 clarity, Type IIa. Est: $1m-2m, sold for US$2,115,000 at Christie’s on June 30 (price includes premium).

Data from online auction marketplace thesaleroom.com (owned by ATG’s parent company Auction Technology Group) shows that from January to September 2020 a total of 109 auction houses held timed sales on its website, an increase of more than 30% on 2019 – see bar charts on facing page.

Blue-chip regional firms such as Tennants, Cheffins and Dreweatts contributed to that total and were joined in October by Sworders, which launched a series of timed sales including wine and spirits, modern British art and books and maps.

Bidders engage

The rise in firms offering items in timed sales has been more than matched by increased engagement from bidders, with the total number of registrations at timed auctions taking place on thesaleroom.com more than doubling to almost 73,000 and the average number of registrations per auction rising 90% year-on-year.

“People are becoming accustomed to the timed bidding format,” says Stephen Whittaker, managing director at Fellows where, excluding pawnbrokers sales, more than three-quarters of auctions held in 2020 will be timed (50 out of 65).

He adds: “Many of our timed auctions are seeing very high sell-rates, notably our first-ever Designer Collection timed sale in June which saw 91% of items sold, and our Online Jewellery sales in April and May seeing 93% and 92% sell-rates respectively. Our Watches Auctions are also continuing to attract hundreds of new bidders.

“We had shifted the Designer Collection sale from live to timed as we did with our Antiques, Silver & Collectables sale in July which attracted over 1000 people registered to bid.”

Good clearance

Auction houses that generally sell lower-value items are also reaping the benefits. In Milnthorpe, Cumbria, 1818 Auctioneers expects to hold 78 timed sales on thesaleroom.com by the end of the year, which contrasts starkly with the number it held in 2019: one.

Crucially, clearance rates are good. “We’ve had a sale with 100% sell-through and another at 97.6%,” says Bill Nelson, the firm’s business development manager. “The average sell-through for our timed auctions is between 7-10% higher compared with live auctions.

“I have a programme planned for 2021 and until there is a change in the Covid-19 situation our full programme of auctions will be timed. So far the programme contains 150 sales.”

Higher hammers

Forum Auctions in London, best known for its books and works on paper sales and among the larger regional firms by total hammer value, has been holding timed sales fortnightly since early 2017. These sales account for two-thirds of all lots offered by its books department and 25% of departmental hammer.

This year the number of lots it has offered in timed sales has risen 10% compared with 2019.

“The gamechanger for us has been a 15% increase in hammer realisations to 140% of low estimate, alongside an increased selling rate to 90.3%,” says Forum chief executive officer Stephan Ludwig.

“We have long considered there to be no ‘practical’ single lot price ceiling for timed online sales. We are regularly selling lots above £5000 and occasionally reach £20,000. The incidence of these much higher-priced lots has increased over the past year.”

While almost all auction houses are still reserving live sales for their fine auctions, which account for the majority of their annual hammer totals, they have come to appreciate the flexibility that timed sales can bring.

“The format presents our buyers and sellers with an ideal reduced friction route to market,” says Forum’s Ludwig. “While we naturally promote in-person viewing ahead of all our auctions, the increased flexibility of the timed online format for shorter catalogue lead times and the ability to hold a greater number of auctions within a short time frame is setting the path to where we believe the majority of the industry will migrate to in the future.”

Indeed, why wait for the next fine auction if a trophy lot can sell just as well now in a single-lot timed online sale?

Consignors who want their money quickly will be interested to know that Sotheby’s used this format to sell a gem-set Cartier diamond ‘tutti-frutti’ bracelet for $1.34 million in April and a Rolex Cosmograph Daytona Paul Newman watch for £1.215 million in July.

“The decision to hold a single-lot online auction is driven by two main factors,” explains Josh Pullan, managing director of Sotheby’s Luxury Division. “The exceptional nature of the lots to be auctioned and our strategy to offer luxury items to collectors all year round.

“The lots represent the best of their kind and often deserve to be presented with all their complexity and details. A digital campaign (including videos, educational editorials and so on) achieves this goal by shedding light on the exceptional characteristics of these lots and by bringing them to life.

“Timing is also key in our decision, as we work with consignors to determine when and where the best place to offer their property is. We are taking the lots themselves as the starting point, rather than trying to shoehorn things into the auction calendar.”

At Bonhams – where timed sales have made up about a quarter of all sales this year, up from 11% in 2019 – a 10-lot timed online auction was held in New York in June 2020 to offer a range of rare documents.

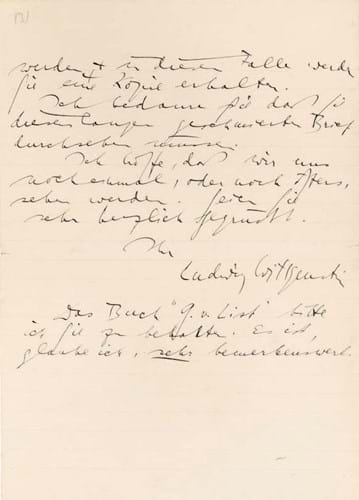

Autograph letter signed (‘Ludwig Wittgenstein’) to Moritz Schlick discussing Gödel’s incompleteness theorems, sold for $137,575 at Bonhams on June 10.

Pitched alongside items penned by Isaac Newton, Immanuel Kant and Mark Twain, two lots achieved stand-out results: the premium-inclusive amount of $187,575 paid for a Renaissance manuscript is the highest value for any object at Bonhams in a timed online sale; while a new record was also set for any letter by Ludwig Wittgenstein – $137,575 (including premium).

The fine books and manuscripts specialist at Bonhams New York, Darren Sutherland, said: “This was a fascinating sale celebrating thinkers and ideas that have transformed the world.

“It attracted interest from around the world and, of course, we were delighted with the remarkable record for the Wittgenstein letter.”

Dual approach

At Dreweatts in Berkshire a timed sale is often held the day after a live sale in the same category. For example, a Wine and Spirits timed sale on September 18 followed the Fine and Rare Wine and Spirits live sale held on September 17. Similarly, in June the live online one-day Jewellery, Silver, Watches, Pens and Luxury Accessories (Part One) sale was followed the next day by Part Two, which was a timed sale.

This arrangement is an efficient method for showcasing top lots – through a live auction – and achieving good clearance rates for lower-value items without the need for the extra costs of running a live sale for the second day. “Timed sales are enormously effective at reaching the UK market while achieving good prices,” says Jonathan Pratt, managing director at Dreweatts.

Viable alternative

Auctioneers will not be hanging up their gavels any time soon.

Live sales – or live online only as almost all of them are at the moment – still account for the majority of all art and antiques auctions and remain, for now, the preferred method of selling most high-value lots.

The rise in timed sales, however, now presents a viable alternative for auctioneers to consider.