The art market may move at a more measured pace than some other industries, but when new ways of selling art and antiques take root, they are all the more impactful.

Recent results for the big London auction houses – where trends are set, to percolate down to other auction houses in the country – suggest that one particular selling model is coming of age.

We’re talking about timed online auctions – or ‘online only’ sales as the big auction houses term them. The bidding for these sales takes place online over an extended period of days as opposed to happening live and are already well known to consumers thanks to eBay.

Other businesses outside UK art and antiques also use this format; for example, in industrial and commercial auctions such as those run on the i-bidder and Bidspotter websites. Regular buyers at US art and antiques auctions are similarly familiar with timed sales where the format has been popular for some time.

Results from 2018 and this year so far, for Sotheby’s, Christie’s and Bonhams, tell a compelling story: that timed sales have become sizeable businesses in their own right, earning their place alongside live formats.

“Traditional auctions remain the core of our business,” says Matthew Rubinger, deputy chief marketing officer at Christie’s. In 2018, the privately owned auction house reported revenues of £5.3bn, of which around 1% was from online sales. “[But] online is growing each year and most importantly, helps us reach a new audience.”

At Bonhams, more than 10% of its 279 auctions will be online-only this year, up from 3% in 2017.

As well as appealing to time-poor, digital-native millennials, timed sales involve lower overhead costs than live and are easier to flex in terms of size and content. Timed online sales of jewellery, watches, accessories, manuscripts, ceramics, Contemporary art, classic cars, design, wine and spirits and even Old Masters are now part of the auction landscape.

Among the format’s early adopters, Christie’s is an instructive case on why the big auction houses have placed large bets on timed online sales.

From a standing start in 2011, when Christie’s debuted the online-only format to sell the collection of the late actress Elizabeth Taylor, annual sales via the channel have grown rapidly. In 2018, online-only sales were £65.1m, up 16% year-on-year.

New bidding base

Rubinger says that for newer bidders, online sales are a more accessible way to transact with the 253-year-old auction house. More than 40% of buyers in Christie’s online sales are new to the firm, he says. This is the firm’s biggest source of new customers “and of our returning customers, half go on to buy in traditional auctions and engage in the top end”.

Likewise, at the Sotheby’s London Old Master Copies sale last September, 56% of the buyers were engaging with the business for the first time, to achieve a sell-through rate of more than 90% and £283,700 hammer, exceeding a pre-sale estimate of £245,000.

Sotheby’s, which in the first wave of the dot-com boom had experimented with the online-only format (the jointly operated auction site sothebys.amazon.com closed in 2002), came later than Christie’s to the timed format this time around.

From small steps in 2015, the firm’s mobile-friendly ecommerce platform delivered $50.7m (£40.3m) in sales in 2018, nearly three times the 2017 total with an average sell-through rate of 82.5%.

“Now 60% of our online bids are coming through mobile devices,” says Noah Wunsch, global head of ecommerce at Sotheby’s.

Auction rigours

Key to those auction houses achieving timed-sale success is evolving the format so that it is not seen as a dumping ground for lots that went unsold in previous live sales. A new selling format does not reinvent the wheel.

And to give a few regional UK firms such as Fellows, Forum Auctions and McTear’s credit where credit is due, their successful use of timed online-only sales is not new and can serve as a reassurance for other auction houses now considering adopting the format.

This oil on canvas board by Scottish artist Alexander Mann (1853-1908) titled Sunset, A House on the Downs forms part of McTear’s timed online sale of British and International Pictures sale on thesaleroom.com, closing on June 30. Estimated at £1000-1500, it measures 10 x 14in (25 x 35cm) and has a provenance to the artist’s family, with a Fine Art Society label verso.

McTear’s launched its timed auctions on thesaleroom.com in January 2013. “Timed auctions are an important part of McTear’s business,” says Magda Ketterer, manager and Asian specialist at the Glasgow auction house. “They work in tandem with traditional live auctions, allowing us to utilise a different type of selling opportunity and to offer another bidding experience to a global audience.”

Jewellery and watches specialist auction house Fellows has also enjoyed good success with timed auctions and is set to double the number of such sales.

“We expect to hold around 20 this year, as opposed to 10 in 2018,” says managing director Stephen Whittaker. “Holding timed only-only auctions is an efficient way of holding a sale without the razzmatazz of a live auction.”

Fellows holds timed online-only sales of jewellery, gemstones, coins and medals, and watches and watch accessories, achieving an average sell-through rate of around 87%. “For a first-time buyer it may be a less stressful process, and it is the perfect opportunity for individuals to take their first steps into the auction world,” Whittaker adds.

This copy of AA Milne’s Winnie-the-Pooh, first edition, illustrations by EH Shepard, from 1926, sold for a hammer price of £1900 at the Modern Literature, Chldren’s and Illustrated Books, Private Press and Limited Editions sale at Forum Auctions on June 20. The estimate was £800-1200.

Stephan Ludwig, Forum Auctions’ chief executive officer, says a key ingredient of the formula is treating lots offered in online-only auctions “the same as those in live sales”, adding that “it is essential the quality of catalogue descriptions and illustrations conform to the same ‘house standard’ across both sale formats”.

Since its inception in 2016, Forum Auctions, the works-on-paper, books and wine specialist, has held regular online-only sales on thesaleroom.com. They now feature on a near-weekly basis, with timed sales delivering £1.1m of Forum’s £8.47m turnover in 2018, up from £550,000 out of £6.9m turnover the year before. Ludwig predicts this format’s turnover at his firm will almost double this year to £2m.

Last week, for example, Forum’s online-only sale on June 20 hammered a mid-estimate £61,000 with a sell-through rate of just shy of 90%. According to the firm’s deputy chairman Rupert Powell, the auction “was typical of what we have been doing for three years now”.

He adds: “The technological modus operandi of these auctions, their huge diversity of content, their frequency, and their popularity with the trade and collectors make them a bellwether for the book world at large in my opinion.”

Applying the same rigours as in live auctions, the most successful timed sales have lots that are market fresh, well photographed, described in detail and with realistic estimates. Some are themed by category or represent a single-owner collection.

Offering the opportunity to view the items in advance – just as in a live sale – also matters, and for reasons beyond simply ensuring a sale is considered an auction rather than be subject to Consumer Contracts Regulations (which replaced Distance Selling Regulations in June 2014).

Forum’s Ludwig says: “Providing prospective buyers with the opportunity to examine lots is an essential service when offering second-hand material, where understanding a lot’s condition is of paramount importance. We would continue to provide this irrespective of distance selling regulations.

“While many of our regular clients know our specialists well enough to rely on catalogue descriptions, images and condition reports, there is of course no substitute for viewing and handling an item in person. Viewing sessions in the days leading up to an online-only sale are well attended.”

Climbing values

At Sotheby’s Old Masters Online sale hosted from New York from May 13-29, 74% of the 99 lots offered were sold at estimates ranging from $800-30,000. This 4ft 5in x 3ft 7in (1.36 by 1.09m) oil on canvas by Francesco Curradi (1570-1661) depicting Tobias and the Angel was estimated at $7000-9000 but sold for $30,000 (£26,700) plus 25% buyer’s premium.

As timed online auctions gain traction in the marketplace, the established view of them as the place to sell lower-value lots – the middle to high end remaining the preserve of offline – is starting to shift as consignors gain confidence in the medium and hammer prices climb.

Wunsch at Sotheby’s says his firm took the decision to move some live sales online based on analysis of bidding data. “If we see a certain category has, say, 70% of their buyers bidding online, it begs the question for us whether this sale should be online-only.”

A particular success has been Sotheby’s Paris Now! series, which mixes Contemporary, design, photographs and African art, and to books and manuscripts “which, when sold online, achieve similar results to live, if not better”.

Rubinger at Christie’s says that at his firm the average online lot value in 2018 was $8357 (£6672), up from $7305 (£5800) the year before.

And exceptional objects will, of course, break through this threshold.

Christie’s nine-day timed online auction in November 2018 titled On the Shoulders of Giants: Newton, Darwin, Einstein, Hawking included a selection of Prof Stephen Hawking’s effects. The physicist’s PhD thesis sold for £584,750 against an estimate of £100,000-150,000.

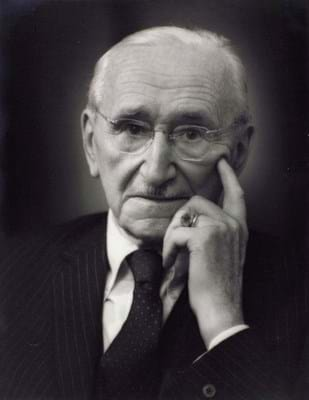

In March this year, Sotheby’s – which back in 2000 sold a copy of the Dunlap Declaration of Independence in a promotional online sale for $8.14m – set a modern-day record for an online-only hammer price when the Nobel prize medal awarded in 1968 to free market economist Friedrich von Hayek sold for £950,000 (£1.15m inc premium).

Results like these are helping to give once sceptical specialists more confidence in the medium as a place to sell valuable works.

Blending formats

Another fundamental to timed success, for those auction houses with strong live auction legacies, is working out a viable way to blend traditional with online-only.

Cheffins, Elstob & Elstob, Watches of Knightsbridge, and Rowley’s are among those UK auction houses that have recently been trying out the timed online format on thesaleroom.com, alongside their traditional live sales. Charles Miller – holding a sale of liner china – is another that is about to venture into the timed space.

In a live sale, smaller-value lots are often combined, which makes it easier for the auctioneer on the rostrum to get through the day’s gavel-wielding but can prove frustrating for the collector who wants only one of the items within a combined lot. With a timed sale, it is no more effort to sell each item separately, allowing the eager buyer to cherry pick at their leisure. The timed format should suit the liner china sale perfectly.

Will even more regional auction houses follow the timed-sale trend, to capture the next generation of buyers?

The big London auction houses, and other pioneering players, have discovered a successful formula, based on an ability to heed the trends contained in bidding data and to segment their sales and channels accordingly.

Attracting quality consignments and a willingness to experiment helps too – ‘twas ever thus in the world of auctioneering.