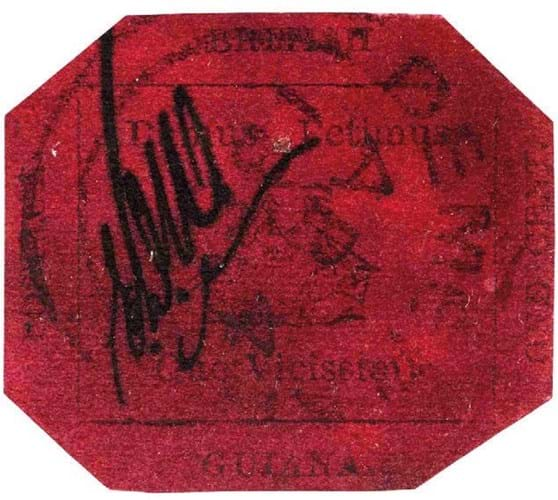

The sole-surviving example of the British Guiana One-Cent Magenta was offered at an auction branded Three Treasures – Collected by Stuart Weitzman on June 8. Estimated at $10m-15m, it was knocked down at $7m (£4.97m), a sum shy of the estimate and also the record $7.9m that shoe designer and collector Weitzman had bid for it at Sotheby’s in 2014. This time round, the price including premium was $8.3m.

Stanley Gibbons, the world’s oldest stamp dealership, said it intended to put the famous 1856 stamp on view at its London premises in The Strand before making it available to “a much wider audience than ever before” through “fractional ownership and the creation of digital collections”.

In effect, members of the public will be able to purchase shares in the stamp which can be traded.

The firm has launched a website, 1c-magenta.com, where people can register their interest in acquiring a stake.

Stanley Gibbons chief executive Graham Shircore said the firm was still finalising the plans but confirmed it was “developing a platform to create a secondary market” for shares in the stamp.

He did not rule out Stanley Gibbons retaining a controlling stake in the stamp but said the company was looking towards a model similar to financial markets where shares come with voting rights. “If someone comes in with an offer to buy it outright, then shareholders can vote on whether to accept it.”

While it is not unheard of for consortiums to buy shares in collectables or individual works of art, or for dealers to invite investors to buy stakes in whole collections, this is believed to be the first time this model has been used in the stamp market.

Shircore said there are many collectors who would “love to own a piece of the world’s most famous stamp but, of course, most mere mortals couldn’t hope to buy it on their own”.

The One-Cent Magenta was produced in British Guiana as part of a contingency supply created following a shortage of the imported stamps.

Made using the printers of the local Royal Gazette newspaper, all were thought to be entirely lost until this one was discovered in 1873 by a 12-year-old schoolboy in South America.

The purchase of the stamp was financed through an interest-free loan from Stanley Gibbons’ majority shareholder Phoenix. As well as this latest initiative, the firm is working with another Phoenix-owned business, Castelnau Group, to develop a new digital platform for collectables trading.

Stanley Gibbons will have “a minority shareholding in the new digital platform at zero cost as well as cost-free access to the platform itself”.

Coin auction record

The 1933 Double Eagle 20-dollar coin – $16.75m (£11.88m) at Sotheby’s, setting an auction record for any coin. Photo: SquareMoose.

The most valuable of Weitzman’s three treasures proved to be the fabled 1933 Double Eagle $20 coin – the only example of 13 specimens in private hands. Estimated at $10m-15m, it drew three bidders before it was knocked down at $16.75m (£11.88m).

The price was more than double the $6.6m it had made in 2002 at a Stack’s Bowers sale conducted on behalf of the US Government. It had required a legal case to decide if the coin – probably the example once owned by King Farouk – could be privately owned. The previous high for any coin, was the 1794 ‘Flowing Hair’ silver dollar sold for $8.525m at Stack’s Bowers in 2013.

Inverted Jenny Plate Block

The third item was the Inverted Jenny Plate Block which sold at $4m (£2.84m) against a $5m-7m estimate to David Rubenstein, the co-founder of investment firm The Carlyle Group.

The result of a philatelic error in 1918 with the biplanes printed upside-down, only one sheet of 100 ‘Inverted Jennies’ was ever distribued. This is the only block of four known.

It last appeared at auction 16 years ago when it sold for $2.97m and was subsequently purchased privately by Weitzman in 2014. Sotheby’s said it becomes the second most valuable philatelic item at auction.

The three lots in the ‘Three Treasures – Collected by Stuart Weitzman’ sale raised $32.1m including premium at Sotheby’s New York last week.

Rubenstein said: “The inverted Jenny is a classic part of the American story. I look forward to placing this American icon on public display to help inspire and educate others about our country’s rich history.”