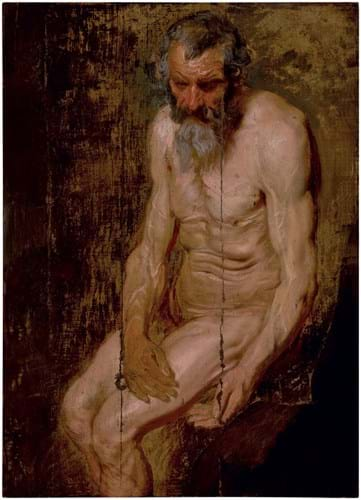

Portrait of a young man with a quill and a sheet of paper by Agnolo di Cosimo, called Bronzino, sold for $9m (£7.32m) at Sotheby’s.

Is the Old Master market becoming more competitive? While this might not always ring true when it comes to bidding, increasingly it seems to be the case in terms of winning consignments.

The latest auction series in New York was notable for a number of reasons, not least the amount of works carrying either bulky estimates or guarantees (or frequently both), indicative of an intensifying struggle to pull in the vendors, especially on the most lucrative lots.

The higher pitches meant the latest series seemed at times to lack a bit of drama as fewer lots drew fierce action on the day.

Consignment battles

The contest for sourcing quality material was partly reflective of a stream of good collections heading to the market, but it also showed the way the auction houses’ Old Master specialists are having to follow the approach of their Modern and Contemporary art counterparts in battling hard against their rivals and cutting deals with sellers.

Sotheby’s offered either direct or third-party guarantees for all 10 lots from the Fisch Davidson collection – the group yielded a hefty $49.6m (£40.3m) in all. Christie’s, meanwhile, arranged third-party guarantees on 10 works at its sale of works from the collection of Jacqui Eli Safra, a curious scenario with the auction being billed as ‘selling without reserve’.

The top lots of the week at both Sotheby’s and Christie’s both carried third-party guarantees and got away below estimate respectively: Salome presented with the head of Saint John the Baptist by Peter Paul Rubens that sold at $23.5m (£19.1m) at Sotheby’s (see News in ATG No 2578), and a pair of Francisco de Goya portraits depicting a mother and daughter that were knocked down below predictions at $14m (£11.4m) at Christie’s.

Nevertheless, such significant sums helped boost the totals and, in fact, the amount generated across the week of auctions at Sotheby’s and Christie’s represented a record for a january series in the Big Apple.

Full series

The fact that Christie’s participated with a full series of Old Masters auctions for the first time since in 2016 was clearly central to this, although Sotheby’s maintained a high-grossing total which was only marginally down on the house record from the previous year’s events.

Christie’s held five sales that included Old Masters (one online), raising over $73m (£59.3m) with premium, while Sotheby’s posted $98.4m (£80m) from six sales, including two separately-staged single-owner sales.

The combined $171.5m (£139.4m) outscored the $133m (£97.1m) total from the New York Old Master sales in January 2021 which represented the previous series high – helped in no small part by a $92.2m Botticelli at Sotheby’s.

This year the money was more spread out around the different sales and individual lots. With a greater volume of works on offer overall and some attractively fresh material, decent interest emerged on certain works despite the sometimes hefty-looking estimates.

Bidding was reported from established private clients, a few new faces (or new to the sector) and also a larger number of museums that successfully scooped up several of the most notable lots.

Rare Bronzino

Arguably the highlight of the series in terms of individual works was a rare Bronzino (1503-72) portrait that came to Sotheby’s mixed-owner Old Master sale on January 26 following its restitution by the German government last year to the heirs of Jewish collector Ilse Hesselberger.

The picture was a ‘discovery’ as well as a restitution – it had languished unidentified for decades in a German government office after being confiscated by the Nazis in 1937-38.

Having long been misattributed to Jacopino del Conte (1510-98), the 2ft 7in x 21½in (78 x 55cm) oil on panel showing a young man with a quill and sheet of paper was recently identified as an early work by Bronzino and possibly a self-portrait (the Florentine artist who worked at the court of Cosimo I de’ Medici wrote poetry from at least 1532).

Working with a number of Italian art scholars, Sotheby’s was able to established a provenance going back to the 17th century (its first known owner was the connoisseur Sir William Temple of Moor Park, Surrey.

Few works by Bronzino have ever emerged at auction. The Artprice database records only 18 entries with the highest previous price being the $8m (£5.29m) for a slightly larger portrait of a young man with a book that sold at Christie’s New York in 2015.

The picture at Sotheby’s had everything going for it: a rare and compelling portrait in remarkable condition and being offered with a strong charitable element (proceeds from the sale were benefiting a number of charities including one aiding holocaust survivors and another being a Jewish healthcare organisation).

Estimated at $3m-5m, the work, which was described by Sotheby’s vice president of Old Master Paintings Elisabeth Lobkowicz as “a true masterpiece of the Florentine Cinquecento”, always looked likely to surpass this level. It drew a five-minute bidding battle on the day and sold to an unidentified bidder in the room for a record $9m (£7.32m).

Van Dyck barn find

While the Bronzino was offered without a guarantee of any kind, another discovery at the sale for which the auction house did arrange an ‘irrevocable bid’ (in effect a third-party guarantee) was A study for Saint Jerome by Sir Anthony van Dyck (1599-1641).

Remarkably, the 3ft 2in x 23in (95 x 59cm) oil on canvas, laid on panel, was discovered in a barn in Kinderhook, New York, in the 1990s with bird droppings reportedly dotted on the back.

It was acquired by the local collector Albert B Roberts who had a passion for ‘lost’ pieces, describing his collection as “an orphanage for lost art that had suffered from neglect”. Convinced of the importance of the sketch, he purchased it for $600 and later in 2019 his find was authenticated as an autograph work by van Dyck by art historian Susan J Barnes. She described it as “surprisingly well preserved”.

It was identified as a study for the artist’s painting of St Jerome in the Museum Boijmans van Beuningen in Rotterdam and it was deemed one of only two large studies after live models from the artist’s oeuvre. It was dated to 1615-18, making it an early work when the Flemish painter was working alongside Peter Paul Rubens in Antwerp.

Roberts died in 2021 and the work came to auction from his estate. While splits were visible along the joints between the three panels and the canvas had been cut away to the lower right corner, the most important areas of the work were unscathed.

Estimated at $2m-3m, it sold at $2.5m (£2.03m) to an anonymous buyer. The price falls within the top 10 auction sums for van Dyck and looked relatively strong given the less-than-commercial subject matter of a naked old man.

Museum purchases

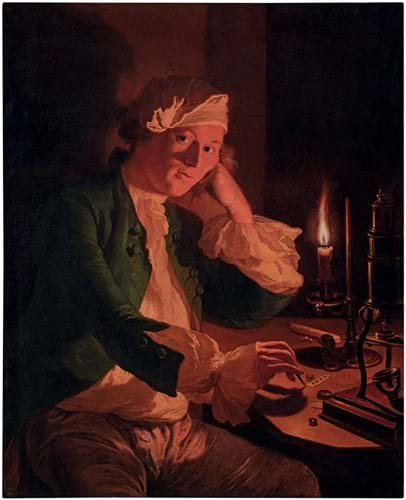

Among the works at Sotheby’s selling to museums was an evocative depiction of a scientist seated at a desk by candlelight by the Prussian painter Anna Dorothea Therbusch (1721-82). It came from the collection of JE Safra – the same source as the single-owner collection at Christie’s (see separate report in this Old Masters feature).

The fact that the low estimate was set at $400,000, over six times the artist’s record at auction, suggested strong competition to gain the picture. It was eventually knocked down at $350,000 (£284,550) to The Cleveland Museum of Art.

While the price was another major benchmark for a female Old Master painter, the Ohio institution was active elsewhere during the week of sales successfully bidding $700,000 (£567,000) for the bronze Apollo flaying Marsyas by Giovanni Battista Foggini at Christie’s – reported in News, ATG No 2579.

Three of the 10 lots from Sotheby’s sale of the Fisch Davidson collection also went to museums.

A depiction of a young man asleep before an open book catalogued as by an ‘artist active in the circle of Rembrandt van Rijn, c.1640-1650’ was estimated at $500,000-700,000 and took a $750,000 (£609,755) bid from the Nationalmuseum in Stockholm.

An unnamed institution acquired a Mattia Preti (1613-99) painting of a man cutting a block of tobacco at $900,000 (£731,705). It had previously sold for £420,000 at Sotheby’s London in 2001 and been acquired the following year from dealer Jean-Luc Baroni by the now divorced couple Mark Fisch and Rachel Davidson.

The most prominent museum purchase came when the National Gallery in London bought Saint Bartholomew by Bernardo Cavallino (1616-56). Measuring 5ft 10in x 4ft 2in (1.79 x 1.27m), the oil on canvas was one of the largest works the Neapolitan artist painted.

It had been bought by dealer Colnaghi at Sotheby’s Amsterdam back in 1988, where it had been catalogued as ‘Spanish School, 17th century’ and it sold around 20 times above estimate at 535,000 Dutch guilders – then approximately £153,000.

After ascribing the work to Cavallino, the dealer sold it in 1991 to Mauro Herlitzka, a New York-based Argentinian collector from whom it was bought six years later by Fisch and Davidson. It was then exhibited under its new attribution at New York’s Metropolitan Museum of Art in 1999.

Here Sotheby’s went for a $2.5m-3.5m estimate. After it was pursued by a number of bidders, it was knocked down at $3.2m (£2.6m), over two-and-a-half times the previous auction record for the artist.

Like the rest of the collection, the lot was subject to a guarantee; in this case one that was offset to a third party. The fact that the third-party guarantor was outbid by the museum means, according to Sotheby’s terms, they “will be compensated based on the final hammer price in the event he or she is not the successful bidder”.

Nice work if you can get it.

£1 = $1.23

Sotheby’s fees: 26/20/13.9% buyer’s premium + 1% overhead premium

Christie’s fees: 26/20/14.5% buyer’s premium