In a 12-month period when the traditional auction market was transformed by digitalisation, many of the leading regional fine art auction houses enjoyed record sales.

The reasons for a remarkable upturn in fortunes were three-fold: the mini art market boom that led to price increases during the pandemic; the positive input of a new generation of buyers turned on by the internet and the focus of the major London houses on the highest-value lots which has led to more consignments going to regional firms.

DREWEATTS

The leading UK auction firm in the calendar year of 2021 was Dreweatts.

Total hammer sales (without premium) at the Donnington Priory were £27.71m, a record for any regional saleroom. Equivalent sales for the firm, owned by art consultancy and valuation specialist Gurr Johns since a £1.25m deal in 2017, had been £14.6m in 2020.

“Next to Covid, the biggest impact in the last year was Brexit. It has meant greater demand for shipping, VAT refunds, proofs of export and other paperwork which is process heavy and requires a higher level of expertise” - Jonathan Pratt, Dreweatts

Managing director Jonathan Pratt says the most important factors behind Dreweatts’ pandemic-era success was good financial control, a healthy pipeline of consignments, a good business development team and a willingness to adapt to new technology.

“When we got into April 2020 with the uncertainty of the pandemic we understood the financial challenges but we had a steady stream of consignments, were able to move to online auctions immediately and had premises where staff could work in small teams safely. We worked throughout the pandemic without a single case of Covid.”

The £3.3m ‘on the premises’ sale at Aynhoe Park in Oxfordshire in January and the £1.2m sale of the Sitwell collection at Weston Hall in mid-November book-ended a successful year. Both were assisted by video and online technology that Dreweatts will continue to use.

Pratt adds: “The virtual tours were prompted by lockdowns but they proved a way for international clients in particular to understand the items in room settings. The viewer can see the colour, the scale and envisage it in their home.”

FORUM AUCTIONS

Gurr Johns’ influence on the market is set to grow in 2022 with the acquisition of books and works and paper specialists Forum Auctions in an allshares deal in December. Forum founder Stephan Ludwig became co-chief executive of the Gurr Johns group.

Forum’s sales performances across the past two years have demonstrated its expertise in ecommerce: total hammer sales in 2020 were £15m (plus £1.4m private treaty sales) and £17m (plus £1.8m) in 2021. In particular, Forum enjoyed great success in the market for Banksy prints: a copy of ‘Britain’s favourite work of art’ Girl With Balloon sold for £200,000 in March. It was one of five examples from the edition of 600 sold in 2021 and one of 19 sold by Forum over the past five years.

LYON & TURNBULL

A 16th century maiolica dish decorated with a scene from the Biblical story of Samson and Delilah by Nicola da Urbino sold for £1.04m at Lyon & Turnbull in October. It came from Lowood House, home of the Hamilton family since 1947.

Lyon & Turnbull’s hammer total for 2021 was just over £21m – by some distance the best aggregate the company has recorded in its long history. This figure does not include the Stone facsimile of the Declaration of Independence that was found in Scotland and sold in partnership with Freeman’s in Philadelphia for $3.7m (£2.85m) or any private treaty sales.

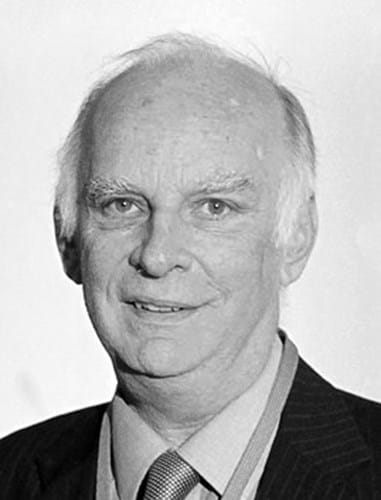

Managing director Gavin Strang is quick to praise the success of sales in both London and in the Edinburgh headquarters: 2021 was a breakthrough year for the dual location model. “We held 42 sales in total in 2021. A growing number of our top sales and staff are based in London and I like to think we are now seen as UK auctioneers rather than solely identified with Edinburgh.”

“We have been experiencing an art market boom during the pandemic. With livestreaming, the audience has expanded massively. I think that online bidding has been seen as more accessible by a new generation who may have never considered entering a physical auction house before.” Gavin Strang , Lyon & Turnbull

Sales in London included the Wilhelmina Barns-Graham collection (including a record £380,000 Hepworth drawing) – one of over 30 named collections L&T presented to the market last year.

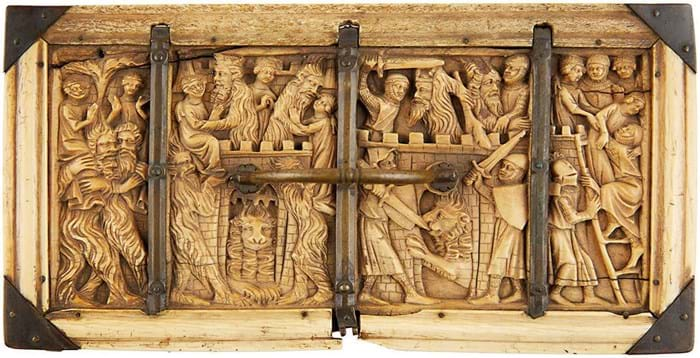

However, two lots became the most expensive ever sold in Scotland: the £1.2m bid for a gothic ivory table casket, c.1330, in May and £1.04m for a Nicola da Urbino maiolica dish from Lowood House in October. That these were for old-school European antiques was unexpected.

“Our seven-figure lots were very much in the traditional collecting categories and represented true ‘discoveries’ by our specialists,” adds Strang.

‘Windfall’ lots were accompanied by an uplift in demand across many collecting disciplines (with Georgian and Victorian furniture and ceramics the exceptions).

WOOLLEY & WALLIS

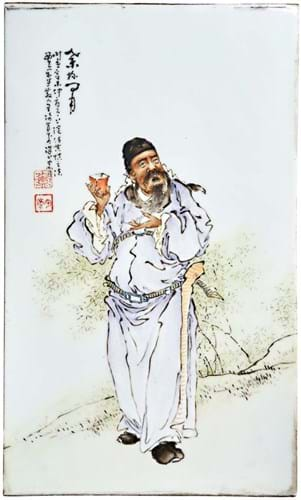

Set of four porcelain plaques (one shown) painted with figures from Chinese history and mythology by Friends of Zhushan artist Wang Qi sold at Woolley & Wallis in Salisbury in July for £500,000.

Woolley & Wallis has been the leading UK regional firm for much of the past 20 years. In 2021 the Salisbury firm conducted sales totalling £20.5m (compared with £14.4m in 2020).

It was the firm’s third-highest total in its history next to the highwater mark of £23.4m in 2010 (when a consignment of imperial jades from Crichel House made £9m) and 2017 (when a significant percentage of sales of £22.9m were provided by the private sale of a Benin bronze head of an oba).

The numbers are all the more notable as Woolley & Wallis chose a singular approach to the covid crisis, furloughing staff and closing for several months in both 2020 and 2021. Last year the firm was shuttered until Easter: the first sales of the year held in late April. “When we did come back we hit the ground running,” says chairman John Axford. “In the following months we held more sales in a shorter time frame than we have ever done before.”

The top prices were for Chinese works of art including the £500,000 bid for a set of four Republican porcelain plaques by Wang Qi. It helped the Asian department to sales of £5.42m but there were significant contributions from jewellery (£3.94m), pictures (£2.96m), furniture and works of art (£2.78m) including the Upper Slaughter Manor house sale and silver (£1.9m).

“When we did come back we hit the ground running. In the following months we held more sales in a shorter time frame than we have ever done before” - John Axford, Woolley & Wallis

The firm is currently putting the finishing touches to a new viewing space at its Castlegate warehouse site at Old Sarum.

In recent years, many lots stored in Old Sarum have been packed and moved the two miles to Castle Street, Salisbury, for sale.

The addition of a new floor to the building will increase the firm’s exhibition space threefold and becomes available in April. All auctions will still be held in Salisbury.

FELLOWS

Fellows in Birmingham reported a good year with the majority of auctions held as timed online. It ran 75 specialist sales, of which just 11 were live. Its 21 pawnbroker auctions brought the firm’s total number of sales in 2021 to 96. “Our online auctions have gone from strength to strength in 2021,” says managing director Stephen Whittaker. “We have seen record numbers of bidders in our weekly jewellery auctions as well as other specialist sales and achieve an average sell-through rate of 80% in both online and live auctions.

“We have kept our buyer’s premium rate at 23% (27.6% inclusive of VAT), despite offering a number of services for free. Notably, we have continued to provide free international shipping as standard on the majority of the lots we sell.

“Online bidding is included in the buyer’s premium, as is all other bidding types including telephone bidding. We even absorb the cost applied by thesaleroom.com for our bidders using that platform.”

SWORDERS

“We are still keen to welcome potential buyers to view pre-sale and to bid live on sale day but, for reasons I quite understand, they do the former not the latter” - Guy Schooling, Sworders

Sworders’ 2021 sales of £11.7m also amounted to the highest in the firm’s 240-year history.

Chairman Guy Schooling says the firm’s performance (up from £9m in 2020 and £9.4m in 2019) ref lected a general increase in prices that were “consistently above prepandemic levels” and “the democratisation of bidding online that has led to many more private buyers”.

Like other auctioneers, he notes European buying had “diminished greatly, post Brexit” but “Modern and Contemporary art sales continued their growth [the Sally Hunter and Ian Postgate collection a particular highlight] and two Asian art sales also far exceeded expectations.

The challenge next year is “to match the 2021 total, hopefully from fewer lots”.

DUKE’S

Single-owner sales continued to attract high levels of interest and some of the strongest results.

Duke’s of Dorchester enjoyed a strong 2021 helped by a series of country house auctions topped by the contents of Wormington Grange in the Cotswolds, family home of the veteran dealer John Evetts, sold for just over £1.5m.

The auction delivered one for the highest prices for a painting sold in the provinces last year, the record £225,000 paid for a Dorset landscape by Algernon Newton.

Turnover more than doubled from 2020 to just over £8m – a figure that excludes a number of private treaty sales which pushed the total towards £10m.

CHEFFINS

Cheffins posted the year’s third seven-figure lot: the house record £1.41m for a late 16th or early 17th century Florentine bronze model of a strutting ostrich from the workshop of Giambologna.

The Cambridge firm’s total hammer sales of £8.5m represented a 65% increase on 2020’s £5.2m.

“As the market for antiques, artworks and collectables continues to gather pace, we have seen consistent growth in our average lot price, particularly at our monthly interiors sales,” says director Martin Millard.

“Buying at auction online became second nature to many throughout 2020 and 2021 and the average number of new buyers at these sales has doubled month on month. We’ve seen over 1728 new buyers come to Cheffins this year, particularly as millennials and Gen Z look to purchase pieces with history and a story, while minimising their impact on the environment.”

TENNANTS

“Auctioneers who had expanded digital offerings prior to the pandemic found it a relatively simple step to switch to online-only sales and established buyers were quick to make the switch too” - Jane Tennant, Tennants director

Tennants in Leyburn achieved total hammer sales of £12.8m with a sold rate of 90%; among the highest in the country.

The firm’s top lot of the year was the Lowry oil People in a Park which sold for £165,000. In 2020, the business achieved a hammer total of £9.9m, having cancelled a number of general auctions during the first lockdown.

However, the firm has since conducted a full roster of sales, dispersing 33,000 lots in 79 sales in 2021.

“Auctioneers who had expanded digital offerings prior to the pandemic found it a relatively simple step to switch to online-only sales and established buyers were quick to make the switch too,” says Jane Tennant.

“A new generation of buyers more familiar with digital transactions have entered the marketplace, further bolstering the industry.”

ADAM’S

'Bluebeard’s Last Wife', a 1921 stained-glass panel by Harry Clarke (1889-1931) housed in a mahogany and walnut inlaid cabinet by James Hicks of Dublin sold for €165,000 at Adam’s sale of Important Irish Art in March. The panel had last sold at Adam’s for €50,000 in 2011.

In the post-Brexit environment, Dublin firm Adam’s generated total sales of €16.38m (£13.65m) – a significant improvement on the numbers posted before the turn of the decade when the Irish picture market, in particular, was in transition.

Managing director James O’Halloran says the firm has enjoyed success in al l departments, with its rebooted Asian art sales contributing significantly to the bottom line alongside more traditional areas of strength such as Irish art and jewellery. A Guan-type porcelain vase with a Yongzheng seal mark, sold for €365,000 in June, was the best result of the year.

The firm held a total of 23 sales, blending showpiece live events with a broadening calendar of online offerings.

ADAM PARTRIDGE

North-west England auctioneer Adam Partridge posted his best figures yet with sales totalling £5.2m (£4.1m in Macclesfield and £1.1m in Liverpool). This compared to sales of £4.5m in 2020. “We are finding the market to be pretty buoyant in most areas and have had many successful sales including the studio ceramics department which continues to grow,” he says.

EWBANK’S

“One of the most important lessons we have learned across 2020 and 2021 is to be versatile and have a can-do attitude” - Chris Ewbank, Ewbank’s

Surrey-based Ewbank’s announced a total of £4.2m in sales for 2021, up 17% on 2020.

Expanding the auction calendar with cost-effective hybrid and timed sales has allowed for significantly more sales and a one-third year-onyear increase in the number of lots offered. Entertainment and sporting memorabilia is now the firm’s biggest seller, accounting for almost 30% of business.

The sale of a private collection of Pokémon and other cards has also provided an unexpected opportunity in a very 21st century collecting sphere.

“One of the most important lessons we have learned across 2020 and 2021 is to be versatile and have a can-do attitude,” says Chris Ewbank. “If you hesitate when opportunities arise, you risk losing them. Potential consignors need to know that you can act quickly, apply the appropriate expertise, bring in the right bidders and turn things round effectively over a short period, if needed.”

REEMAN DANSIE

In Colchester, Reeman Dansie posted total sales of £4.8m for the year, including £100,000 in January for the Mary Beale portrait of her son Bartholomew – a record for the artist.

“We found the market as a whole very buoyant over the last year,” says managing director James Grinter.

RICHARD WINTERTON

Richard Winterton of Lichfield, which broke through the £2m barrier for the first time in 2018, came close to passing another milestone in 2021 with total sales of £2.9m (compared to £2.75m in 2020).

Winterton says there has been no big-ticket single sale, “just good old-school auctioneering with every lot treated in the same careful way regardless of what it is”.

ROGERS JONES

Welsh auctioneer Rogers Jones passed sales of £3m for the first time in 2021. The firm, conducting sales in both Cardiff and Colwyn Bay, said the rise in average lot value, the creation of specialist departments and the increased spending power of many buyers during the pandemic had led to its best ever aggregate. Ben Rogers Jones told ATG he had sold 343 lots for prices over £1000 in 2021 compared to 240 in 2020, while website traffic was up by 18%.

Welsh art continued to contribute handsomely to the bottom line: in 2021 the firm achieved record prices for a Sir Kyffin Williams oil, work on paper and print. However, Rogers Jones also said it had been the best year for ‘non-Welsh items’. Wristwatches, jewellery, rugby collectables and Asian art are all disciplines now covered by specialist valuers.

The firm marks its 30th anniversary in 2022: founder David Rogers Jones is still busy valuing, over 60s years since his first auction in 1961.

Challenges and opportunities of an ever-changing world

Seismic changes in bidder behaviour are causing the auction process to evolve at pace. Most firms are in a state of considerable flux.

At one end of the spectrum, this may mean ‘front ending’ the selling process, creating condition reports and extra images at the cataloguing stage rather than at the eleventh hour. It may also mean cutting the print run for catalogues or only publishing them for major sales.

At the other, it is questioning whether the high-street saleroom is necessary when attendances are in single figures.

For most of the top firms these changes are partial rather than absolute.

All remain committed to print (a smart catalogue is a key weapon in the battle to win the single-owner consignments) and are focused on offering clients the choice to view and bid as they wish, be that virtually or in the room.

“Viewings have bounced back and many people do come and see the items in person. The difference is they won’t stay for the sale,” says Gavin Strang of Lyon & Turnbull. “For example, the £1.8m Lowood House auction we held in October was a classic ‘country house’ sale where we might have previously expected a capacity crowd. I think we had six people in the room – the bidders were all online or on the phone.”

Guy Schooling of Sworders concurs. “We are still keen to welcome potential buyers to view pre-sale and to bid live on sale day but, for reasons I quite understand, they do the former not the latter. I think this is a fundamental change which will not be reversed.”

In terms of live and online sales, a combination of the two appears to be the favoured approach.

Fellows is now conducting the large majority of its sales without an auctioneer: 85% of its specialist sales in 2021 were held as timed onlin events.

Going forward, Dreweatts will hold timed sales for lots between £500-2000, which Jonathan Pratt says are “much easier to sell online and consigners are happy with that”. However, the firm is now looking to impose minimum lot thresholds similar to those in play at ‘live’ sales.

Pratt adds: “We will avoid low-value timed sales. We won’t increase the number of timed sales but will increase the value of the sale instead.”

For many salerooms the next step in the digital revolution is to complete the circle of the buying process – covering all bases from consignment to delivery.

Improving the post-sale service with the provision of cost-effective packing and shipping is, says Richard Winterton, “going to be increasingly important but a huge challenge”.

Some top firms have tackled the process already and reap the benefits: Fellows enjoys an average customer satisfaction rating of 4.7 out of 5 via almost 1800 reviews on Trustpilot with its policy of ‘free international shipping as standard’ on the majority of the lots it sells – including those in its Antiques, Silver & Collectables sales – being among the key reasons for positive feedback.

However, for many regional competitors, this aspect of 21st century auction business remains very much a work in progress.

“The migration to online buying has transformed us into an e-commerce business but the hole in the system has concerned me for some time,” adds Schooling. “Viewing, bidding and paying online are all now perfectly straightforward. However, when the purchaser wishes to have his items delivered, there has been a void.”

In an effort to adapt to a ‘retail’ type environment, the firm offers a post-sale delivery service at cost price. Already more than 3000 items have been shipped.

The issue is complicated by the import and export restrictions that now exist when moving art and antiques to and from Europe.

“Next to Covid, the biggest impact in the last year was Brexit,” says Pratt at Dreweatts.

“It has meant greater demand for shipping, VAT refunds, proofs of export and other paperwork which is process heavy and requires a higher level of expertise. But we recognise this and are developing a strategy for in-house delivery and shipping. The Amazon generation is here to stay and they demand that kind of service.”

This article presents a selection of annual hammer totals as reported by auction houses to ATG. It does not represent a comprehensive survey. Other totals we receive will be added to the online version of this article.