The most valuable of collector Stuart Weitzman’s ‘Three Treasures’ offered at Sotheby’s New York on June 8 proved to be the 1933 ‘Double Eagle’ $20 coin – the only one of 13 specimens in private hands. Estimated at $10m-15m, it drew three bidders before it was knocked down at $16.75m (£11.88m); a record for any coin. The price was more than double the $6.6m it had made in 2002 at a Stack’s Bowers sale conducted on behalf of the US Government. It had required a legal case to decide if the coin (once owned by King Farouk) could be privately owned. The previous high for any coin was the 1794 ‘Flowing Hair’ silver dollar sold for $8.525m at Stack’s Bowers in 2013.

Against the seemingly unpromising background, 2021 was a remarkable year for the coins and medals market.

“Throughout 2021 the value of coins, medals and banknotes continued to rise, particularly for the very best material,” says Pierce Noonan, CEO of Dix Noonan Webb (DNW). “This step-change in value tempted many new consignments to market, the result being a period of both rich supply and unparalleled demand.”

ATG has now tracked the totals achieved by all of London’s coin auction houses for more than 25 years. When we first published these annual tabulations in 1994 the total was £9.3m. For the second year running the hammer total for the main numismatic sales in London has exceeded £50m, rising 5.25% to reach a record £55.7m.

The accompanying tables and charts in this special report suggest a relatively steady increase in business across a quarter of a century. However, the market has undergone seismic changes in very recent years. Many speak of the ‘lockdown effect’ that provided would-be collectors with more time, more focus and more disposable income.

“The legacy of the pandemic on the collectables market has been profound,” adds Noonan. “Online resources and bidding technology have become the norm for all generations of collector, making collecting coins, medals and banknotes more accessible than it has ever been before. Large numbers of new buyers entered the market for the first time, many of whom had never bid at auction before.”

Portable, multiples and subject to grading, coins, medals and banknotes are well suited to the e-commerce that has thrived in the Covid era. Most auction houses were well placed to take their sales completely online at a time when face to face transacting was impossible.

Certainly, more fairs were held in 2021 than in 2020 when the calendar was decimated. However, the sense remains that fewer fairs has meant more consignments to auction. Year on year there was an increase of more than 10% in the number of lots offered at auction.

Top spot regained

DNW has regained its place at the top of the 2021 table with a 17.66% increase in hammer take to £16m (this despite a 3.94% decrease in the number of lots offered). It made its biggest gains in coins, tokens and commemorative medals (8.64m), increasing sales by over 38%.

The rarest British gold coins and those in good condition are setting new benchmarks, aided by the rise in third-party grading that allows one coin to be easily compared with another.

It was a record year for the Spink coin department, which in 2021 posted hammer sales of £11.47m. Highlights included the £1m Dr Tony Abramson collection of Dark Age coinage (March and September) and the parcel of hammered gold coins from the fabled Horace Hird collections sold for £2.8m during Coinex week.

Worthy of note

Delving a little deeper into Spink’s numbers, the firm sold a total of 6211 banknotes in 15 sales for £3.39m in 2021, putting it comfortably in the ascendancy in this growing category.

In the 1990s the banknote element was relatively small beer but the rewards are now there to be reaped. The five-figure bank note is no longer uncommon: already this year, as part of NYINC, Spink has sold a single 1920 Zanzibar 500 rupees note (one of only two known in private hands) for $240,000.

DNW sold 3315 lots of banknotes for £1.41m.

It is the sign of a vibrant market that a handful of numismatic records fell in 2021.

Few results had the financial clout of the fabled 1933 ‘Double Eagle’ $20 – once more the most expensive coin with a price tag at Sotheby’s in June of $16.75m (£11.88m) – but there were also records for Cromwellian and Elizabethan numismatics.

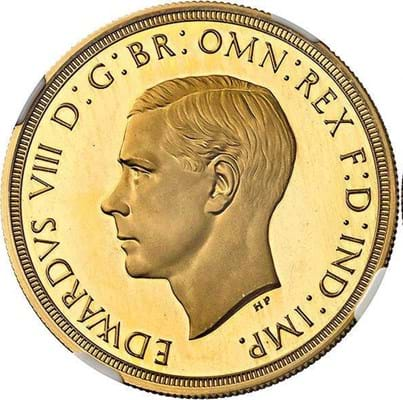

The auction high for a British coin was broken twice, by the same coin. The Edward VIII proof pattern £5, hammered for $1.9m (£1.39m) at Heritage Auctions in Dallas in May reappeared in Monaco in October to sell for €1.76m (£1.48m) at Monnaies de Collection (MDC).

Ancient coins

Classical coins specialist Roma Numismatics can make a claim to be London’s leading coin auction house with sales of £13.42m. This aggregate was down on the remarkable total of £17.8m in 2020 when the firm leapt from third to first in the table with a number of spectacular individual results (including a £2.7m Brutus Eid Mar-type gold aureus – a record for any classical coin).

These can explain away the deficit (the equivalent figure in 2019 was £9.78m), although there may be a bigger picture to consider. Much of Roma’s merchandise comes for sale from overseas vendors and the Brexit import duties now in play may be starting to bite.

Medals and decorations, typically a more localised market, continued to be a strong suit. Both leading players speak of new clients competing with seasoned collectors. Spink recorded a selling rate of 99% – something it attributes to the “huge surge in interest in its online-only auctions”.

Marcus Budgen, head of the department, says: “This method of selling will probably never replace the rostrum auction but is clearly here to stay as an alternative as we move into the digital age.”

As ever, quality, unusual and fresh-to-market items flew away. This included both historic awards from conflicts in the late 18th to the early 20th century and more recent medal groups that are rare both in the small numbers awarded and the handful available to commerce.

The overall impression is of a strong market. However, the table also underlines that the results are rarely spread evenly. The major change to the status quo last year was the amicable parting of waves between Baldwin’s and St James’s Auctions after a four-year tie-up.

Baldwin’s is now running its auctions from the newly refurbished 399 Strand office where parent company Stanley Gibbons Group is based. It held only one solo sale in 2021 so its number is modest.

St James’s, still based at 10 Charles II Street, was much more active in the auction market, holding a series of sales after the April split.

Sovereign Rarities returned to the rostrum in 2021 after a hiatus in 2020, holding two sales hammering at £2.4m, while there was a £1.16m two-sale contribution from the old established philatelic dealership Harmers – now part of the Bolaffi Auction Group – which held its first coin sale in 2020.

Less business than usual was done by Morton & Eden but the firm can lay claim to one of the best coin discovery stories of the year: the finest-known example of a New England shilling found in an old sweet tin in Northumberland.

This £220,000 sale and other notable moments from the numismatic year appear in the following report.

Buyer’s Premiums

- Morton & Eden 20%

- Spink 20%

- St James’s 20%

- Bonhams 20%

- Dix Noonan Webb 24%

- Harmers 18%

- London Coin Auctions 17%

- MDC 20%

- Roma Numismatics 20%

- Timeline Auctions 25% inc VAT

- Sotheby’s New York 25/20/13.9%

- Heritage 20%