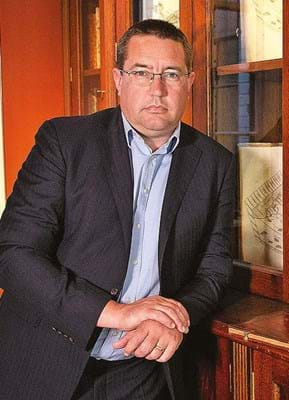

“It used to be very straightforward for me to go to a German auction house to buy a Dutch sea atlas by Waghenaer (1534-98), as I did last year, and buy a few other things while I was in town. You never knew what connections you would make. Now I’m more likely to stay at home and bid, leaving the shipping up to an agent,” he says.

With Great Britain having left the EU’s customs union on December 31, customs declarations will need to be made for sales in both directions from July 1. “Added to this, we can no longer hand-carry items over EU-UK borders, so my motivation to go has decreased.”

Selling and buying

The EU accounts for a third of the firm’s sales – to private buyers, libraries and other institutions – and for about 50% of its sourcing.

Leaving the EU’s single market means the UK’s advantage of having zero-rated VAT for books and maps “is lost as we now have to deal with a whole raft of different VAT rates across the EU,” Crouch says. “So, while a book may leave the UK duty-free, its arrival with customers incurs a duty.”

One adjustment Crouch is making for the increased bureaucracy is to “work more with professional shippers and customs agents, rather than just wrapping the items up ourselves in the shop and sending them via postal courier”.

He is resigned to absorbing any extra handling charges from shippers and couriers – “they have to cover their extra costs too” – and the import tax that EU-based customers must now pay).

“We can absorb these costs without too much pain because we have a relatively high average sale value,” Crouch says, “but if you’re dealing with hundreds or thousands of small sales a year, the hassle factor is enormous.”

Protecting the margin

As treasurer for the Antiquarian Booksellers Association, and in charge of its export committee, Crouch hears many such tales about members’ difficulties with the new rules.

“Lots of my colleagues make their living in the £200-400 range and it’s incredibly difficult to make a margin when you’ve got a £12 handling fee from your shipper, a duty charge and a customs declaration to fill every time you ship a book,” he says.

An Irish solution

All that said, the EU remains “very important” to Daniel Crouch Rare Books. “Brexit hasn’t changed where the material we want is located and our EU customers haven’t changed either – not yet, anyway,” Crouch says.

Vowing to “find ways around this new trade friction,” Crouch has begun using the Republic of Ireland, an EU member with a zero-VAT rate for books, as a base for dispatching to the rest of the EU without paying import tax.

Top tip

“Get a good shipper or customs agent – they are absolutely worth the cost,” he advises. “We use Art Logistics, who are first rate. I could consolidate a buying trip to Paris with them, and not have to think about handling all the paperwork.”

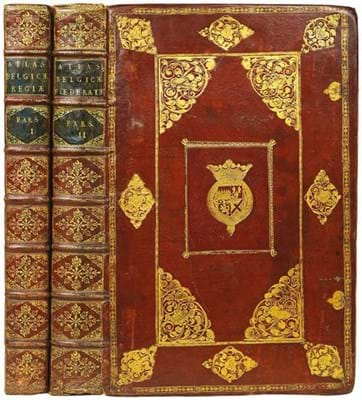

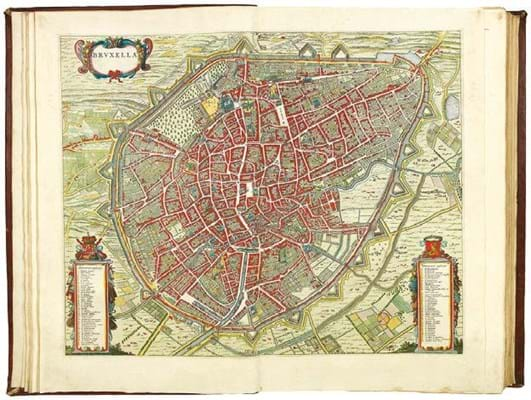

To illustrate the increased cost of selling into the EU, Crouch picks a two-volume town book of the Netherlands by Dutch cartographer Willem and Johannes Blaeu (1652).

“We’re in an interesting position in our world as while books and maps remain zero-rated for VAT in the UK, they attract different rates of import VAT (or ‘TVA’ in French) in EU countries,” he says.

Purchased by Crouch in Belgium in 2019, the Blaeu book is being sold back into Belgium but now with an added import tax of 6%.

As Covid-19 delayed delivery into January 2021 – Great Britain having just left the EU’s single market and its VAT regime – Crouch is paying the import VAT as part of the transaction.

“It’s a substantial portion of our margin, but we’re paying it as the customer ordered the Blaeu before the new tax regime kicked in.”