Richard Brierley, head of fine wines and collectable spirits at Forum Auctions, owner of Bid for Wine

Richard Brierley of Forum Auctions.

It is now more than 20 years ago since Andrew Lloyd Webber sold part of his wine collection at auction in May 1997 for £3.7m. The highest grossing wine auction at the time was conducted to a packed room (most notably representatives from a casino in Las Vegas) in an atmosphere that was electric – not electronic. So began a seismic shift in the dynamics of the marketplace.

The Lloyd Webber sale was the start. As technology, regulation and macro-economic factors took hold it also marked an end of the market in its time-honoured guise.

The following year wine-searcher.com was founded as a transparent aggregator of wine prices for merchants around the world.

By 2000 Liv-ex had started its trade-only stock exchange for fine wine and shortly thereafter auction houses around the world were exploring the idea of accepting bids live via the internet. Auction Technology Group’s own platform thesaleroom.com started accepting live bids in 2006 and two years later our company Bid for Wine (now part of the Forum Auctions group) was founded as a person to person online-only wine marketplace.

Hong Kong opens up

The internet afforded a global reach at a moment when the primary consumer was starting to change. The key year was 2008 and the decision by the Hong Kong’s government to abolish once punitive taxes on wine. The move prompted an explosion in interest in wine not only in the special administrative region but in Greater China and beyond. That continues today.

The merchandise is changing too. While Bordeaux dominated wine auctions of the 1990s and 2000s, the new generation of collectors discovered Burgundy, mature vintage Champagne and much more.

In America the so-called ‘cult Californians’ became much sought-after. The Chinese collectors followed a similar path; pouncing on the branded Bordeaux chateaux first but now equally fervent about the small production vineyards of Burgundy and recently whisky – both Scottish and Japanese.

Perhaps not surprisingly, given the wealth creation in many parts of the world, the past decade has seen an exponential rise in prices with records tumbling monthly. Last year a bottle of Romanée Conti 1945 from the personal cellar of Robert Drouhin, patriarch of Maison Joseph Drouhin, made over $500,000 in New York while exceptional cellars of wine now rival impressionist pictures in price.

A cool $34.7m million was raised for the Henri Jayer cellar auction held last year at Domaine de Châteauvieux in Geneva by Baghera Wines.

At the end of this month (March 29-31) Sotheby’s Hong Kong will hold a sale of 2704 lots (16,889 bottles of wines) from an extensive private cellar with an estimate of $19m-26m.

Approachable prices

Despite this, there remain exceptional mature wines at more approachable prices and this is perhaps best illustrated by the wines of the Rhone Valley which seem to have largely escaped the hyperbolic price rise and offer delicious drinking to the savvy buyer.

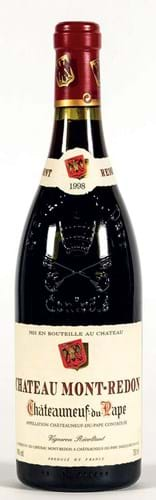

Consider the six bottles of Crozes-Hermitage Domaine de Thalabert Paul Jaboulet Aine 2009 – a single vineyard wine from one of the region’s top producers approaching 10 years of age - sold for £120 by Bid for Wine in February. In January we sold a 12-bottle case of Chateauneuf du Pape, Mont Redon 1998 for £350 – a fully mature Southern Rhone star for under £30 per bottle. Some North American reds also offer great value.

The first ever vintage of Cabernet Sauvignon made at Rex Hill in Wilamette Valley, Oregon, is the 1992 Reserve. A lot of six bottles sold for £120 in November – proof that there are plenty of opportunities to explore new wine regions and vintages on a reasonable budget.

Sam Hellyer, head of wine at Chiswick Auctions, London

Sam Hellyer of Chiswick Auctions.

Since the advent of the internet it has been relatively simple to compare the retail prices of fine and vintage wines with previously realised auction prices. Key has been the arrival of Liv-ex, the international trading exchange founded by two stockbrokers in 2000 that follows the progress of the fine wine market via a number of different indices.

The Liv-Ex Fine Wine 100 index has tracked the fortunes of the 100 most sought-after wines since 2003. Although the year-on-year ride has been a roller-coaster, it has more than trebled across 15 years.

The biggest buyers are from New York, Hong Kong and China.

Sotheby’s sold £100m worth of wine for the first time last year – 25% of it to buyers in the US and 39% to those in Hong Kong and 12% to China. Buyers in the UK bought $7m worth of wine at Sotheby’s in 2018.

Can it continue? Much depends on the consumer in China where homegrown wine is now available. It could reduce demand for imports. It might just bring more knowledge into the market and encourage further demand for classic Old and New World wine.

Auctions houses like us are moving to sell more bottles of interesting mid-range wines and are happy to sell fine wines by the bottle rather than the case.

Mixed lots, containing different vintages of the same wine (verticals) or different wines of the same vintage (horizontals) or an assortment of diverse wines, often prove popular. When offered in this way, they appeal not just to wine collectors and restaurateurs but to buyers who come from other fields.

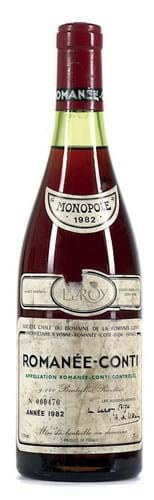

Domaine de la Romanée-Conti dominates international wine auctions. This single bottle of Cote de Nuit 1982 sold for £6500 at Chiswick Auctions.

Burgundy purple patch

France is still king. It is still the prestige brands that dominate the wine market and any change to the status quo is slow.

Burgundy is growing in popularity, partly because of scarcity (production levels are smaller than for Bordeaux) and partly through drinking fashion. Liv-Ex shows that Burgundy has nearly doubled in value across the last five years.

Grand Cru vineyard Domaine de la Romanee-Conti is the favourite. Chiswick Auctions' highest-priced single bottle last year was a Romanee-Conti Cote de Nuit 1982 for £6500.

However, there is no doubt we are seeing more Californian and Australian wines coming into cellars. The key Californian movers are the likes of Screaming Eagle, Opus One, Dominus, Harlan Estate and Ridge Monte Bello. The 2008 Monte Bello can sell for £1500 a case.

Australia’s most revered brand is Penfolds Grange: we sold six bottles of the 1987 Shiraz in our December sale last year for £1300.