The capital’s auction scene has seldom seemed more dynamic.

A generation or more ago the UK’s international fine art auction houses used a broad brush and satellite rooms to capture most elements of the market within the M25. However, slowly but surely, since the turn of the 21st century, London has once again become a hive of multi-venue auction activity.

In 2019, the choice is bigger than ever before – and the market is big enough to cope with it all.

Minimum lot values hardly sound the stuff of a saleroom revolution. And yet this exercise in number-crunching – the financial thresholds at which auction houses are willing to accept items for sale – is at the heart of discernible change in the London landscape.

In the knowledge that half a dozen blue-chip pictures can make the difference between a good and an indifferent year, the business model of the so-called ‘big four’ is now to expend more effort in securing fewer, but higher-value, items for sale.

It’s why this summer, visitors to Mayfair, Knightsbridge and St James’s will be able to marvel at showpiece sales of objects from the top 1% of the art and antiques market. Where else could you find a miniature table clock made by Thomas Tompion for Queen Mary II (estimate £2m-3m at Bonhams on June 19) or a rediscovered element from the Lewis Chessmen hoard (estimate £600,000-1m at Sotheby’s on July 2)?

Mere mortals who share the art and antiques collecting bug would do well to look at the city’s wide array of ‘middle market’ auction houses for the full panoply of objects on offer where the entry level is £50 rather than £5000.

London has once again become a hive of multi-venue auction activity

Specialists emerge

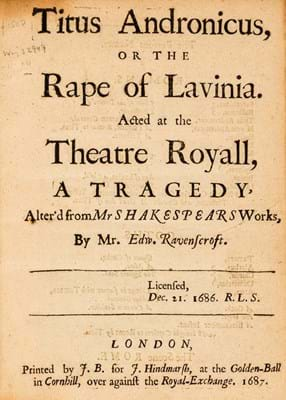

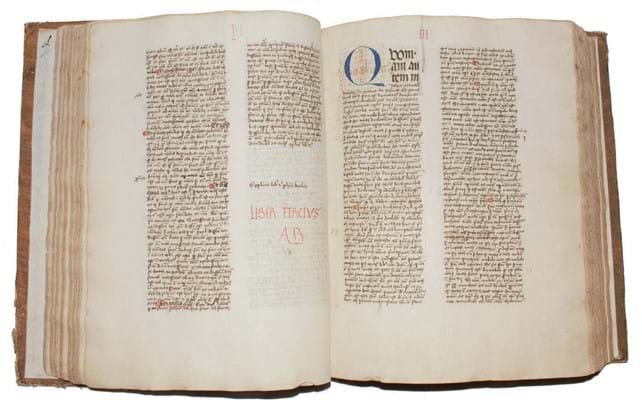

London’s ‘second tier’ began with the birth of the specialist saleroom. Once confined to ‘stand-alone’ disciplines such as stamps and numismatics, since the turn of the century niche firms have emerged to cater for disciplines as diverse as musical or scientific instruments, maritime memorabilia, sporting collectables and fashion. Many were formed as these ‘minor’ departments were cut loose by Sotheby’s and Christie’s a decade or more ago.

Some collecting areas such as toys, mechanical music and cameras, moved wholesale out of London to firms such as Special Auction Services in Newbury, Berkshire.

Direct interest in others such as vintage fashion, sporting memorabilia and marine antiques were shelved in favour of partnerships with former specialists who – without wholly cutting the apron strings – were given the means to begin trading on their own.

In 2007, Thomas Del Mar, a former Sotheby’s specialist in arms and armour who began to trade ‘in association with Sotheby’s’ in 2005, moved to Blythe Road near Kensington Olympia to develop an auctioneering hub that now includes half-a-dozen independents operating as a cooperative under one roof. The firm now trades as Olympia Auctions.

More recent is the arrival of books and prints specialists Forum Auctions, scientific instrument specialist Flints and furniture specialist The Pedestal founded by ex- Bonhams specialists. The internet – and particularly marketplace platforms such as thesaleroom.com (an ATG sister brand) in the UK – has provided them with the global reach once denied to smaller auction houses and dealers.

Chiswick’s progress

Most remarked on has been the emergence of Chiswick Auctions as a recognised force at the mid-market level – the west London firm making a serious effort to capture some of the business left behind when Christie’s secondary saleroom in South Kensington closed in 2017.

Since September that same year, Chiswick has operated a South Kensington showroom manned by a group of former Christie’s staff while quickly building a structure of more than 20 specialist departments. Last month it announced the doubling in size of its saleroom and headquarters in west London.

Leigh Osborne, managing director of Chiswick Auctions, said: “This will be the busiest autumn we will have ever had. More viewing space means we can display sales for longer and allow for crossover between departments. This should create cross-buying for customers such as those looking at luxury handbags and Asian art sales.

“We are trying to get our point across that we are a major London player now. What has been holding us back was our space and that has now changed.”

Coins & Medals – A Case Study

In 1994 coin, banknote and medal sales in London totalled a respectable £9.3m. Today, a quarter of a century later, numismatic sales in the capital contribute close to five times that number at £42.6m.

The market has proved remarkably robust for close to two decades: a growing interest in 20th century gallantry orders and decorations mirrored by the strong performance of professionally-graded British gold and silver coinage, particularly the milled coins (those made in a machine press rather than hammered between a pair of dies) that have made huge strides in the recent market.

New collectors, from both the UK and overseas, continue to enter the field as older collectors chose to sell up. Among the beneficiaries has been Dix Noonan Webb, last year’s market leader with close to 29% of that £42.6m turnover.

Among the highlights of the Robin Scott collection of medals awarded to casualties is this Waterloo medal to Captain William Buckley, 3rd Battalion, 1st Foot (Royal Scots). Buckley, who was born around 1772, was severely wounded at the storming of the breach at St Sebastian in July 1813, was again slightly wounded at the sortie from Bayonne in April 1814 and was killed in action at Quatre Bras on 16 July 1815. He was the most senior ranking fatality in his regiment at Waterloo. Estimate £10,000-15,000 at Dix Noonan Webb on July 17-18.

Anniversaries have helped fire the market. In April this year, rival Spink produced its largest-ever medals catalogue (more than 1000 lots that ran to nearly 500 pages) with a special section to mark 100 years since the founding of the RAF. After some post-sales it achieved a selling rate of 97%.

No surprise it is a highly competitive market. Interest continues to grow among UK regional salerooms and London now has a dozen or more firms with a close interest in the market from Roma, which concentrates almost exclusively on coins of the classical world, to Heritage, the Dallas-based firm that made its debut in 2017 with the takeover of London Coin Galleries in the Shepherd Market area.

Only last year Sovereign Rarities held its first auction in September in association with shareholder The Royal Mint. It achieved a total of £2m from 613 lots of predominately British historic issues across all periods of coin production from the reign of Alfred the Great (871-99) to modern gold and silver proofs.

The firm is expanding into the next-door office complex after spending £1.3m on the property and will retain its existing office on Colville Road and the warehouse across the street. As well as the shop in South Kensington it has an office in Edinburgh.

Osborne added: “Five years ago we were 20 people. We are now 80. Two years ago we were in one building and now we have five. This is a big change for us.”

Chiswick’s recent arrival in the Royal Borough of Kensington and Chelsea and the expansion of specialist sales at Roseberys in West Norwood are proof that during the retreat of the major brands from the traditional middle-market heartland neither merchandise nor expertise has been lost to buyers. Both have simply migrated elsewhere.

Regional outposts

However, in recent years it’s not just London-based auction houses that have created a foothold in the capital. A number of well-known regional salerooms have a permanent London presence in the ‘right’ parts of town: Woolley & Wallis (Clifford Street), jewellery specialist Fellows (Charles Street) and Dawson’s (Hampstead).

Earlier this year Sworders, with headquarters in Stansted Mountfitchet, has opened in Cecil Court in the heart of London’s theatre district, a street that is already a favourite with collectors of antiquarian books, maps and silver. Plans are afoot for a sale devoted to ‘London’ from period maps to Swinging Sixties memorabilia.

These premium spaces are typically for meetings, viewing and valuations rather than a rostrum but the model is also being tested by firms such as Derbyshire auction house Hansons’ Teddington project or Lyon & Turnbull’s gallery in Connaught Street.

The latter, an Edinburgh-based firm, has used this modestly sized space for a handful of boutique academic exhibitions – the latest spotlighting the work of three 17th century women artists running from June 24-July 6. Recently the firm hired the Mall Galleries for a £1m sale titled Modern Made, spotlighting 20th century creativity across multiple media.

Think you have the market covered by attending just the busy calendar of sales at Bonhams, Christie’s, Phillips and Sotheby’s across the summer season? Think again.

Alderley House sale

Sworders is to sell the principal contents of Alderley House on July 23. The stand-alone sale in the auction house’s Stansted Mountfitchet headquarters will feature more than 500 lots, selected highlights of which can be viewed at the firm’s London premises on July 3-15.

Alderley House, a mid-19th century Grade II listed country house by the English architect Lewis Vulliamy near Tetbury, Gloucestershire, became a family residence once again in 2009.

During the tenure of the Day family, the 14-bedroom house was furnished in the English country house style with ample quantities of Georgian and Victorian furniture and chatells. When the house was sold in 2017 the contents were placed in storage. The Day family are now relocating to the United States.

The July 23 sale will be remarkable for the sheer quantity of good quality period furnishings: more than 66 container loads of art and antiques formerly at Alderley House are coming to Sworders. Estimates will range from £100 for a Victorian wall clock to £5000 for an early 18th century Flemish tapestry.