What can a report examining macro-level trends in the global art market tell us about the middle- and lower-markets, where so many art and antiques businesses reside?

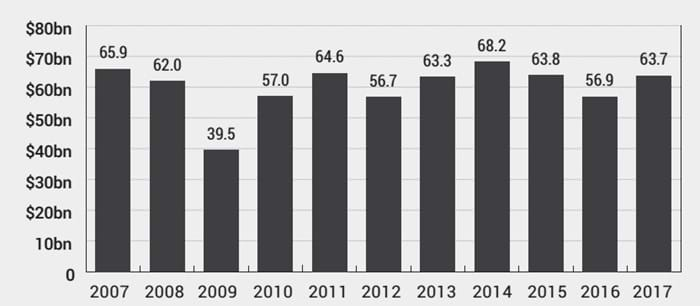

Published earlier this month, Art Basel’s The Art Market 2018 report found that the world’s art market was worth $63.7bn in 2017, up 12% on the previous year (but not back to the high of 2014 or the level of 10 years ago).

So huge are the top-line numbers quoted in the report, that it must be tempting for small-to-medium (SME) sized art market firms to think, nothing for us to see here.

For instance, when the report says the market has “turned a corner”, it is referring to the upper echelon of the business. “In 2017 we really saw a spike in the high end,” report author Dr Clare McAndrew told ATG. “Around a third of the market in terms of value is over the $10m bracket and the dealers that are doing the best are those turning over more than $50m.”

This has created a market dichotomy which began, McAndrew says, “in 2010 when the top part of the market pulled away from the rest, following the recovery [after the dip in 2009 when it slipped to $39.5m]”.

Opaque market

Big numbers aside, the report is one of the few global bellwethers in an opaque and hard-to-measure market and, away from the dizzying highs of contemporary, many of the findings may ring true for “the rest” – that is, SME art market firms.

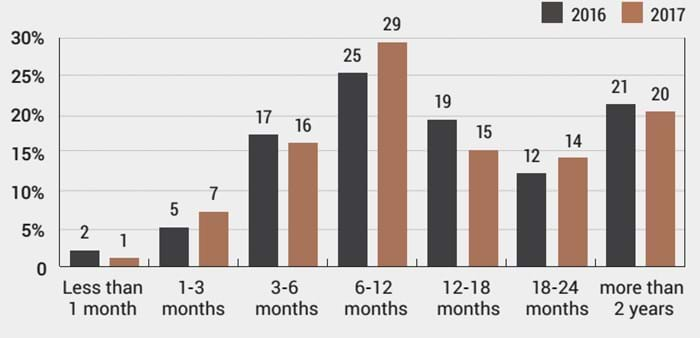

Do smaller dealers agree, for example, that the value of dealer sales in 2017 rose by single digits (4% year on year)? When asked how long it takes to make these sales, a third of dealers surveyed cited 6-12 months, with 71% of dealers in antiques and decorative arts saying their average inventory cycles were greater than a year.

The latest BADA fair – according to Dr Clare McAndrew’s latest report 71% of dealers in antiques and decorative arts said their average inventory cycles were greater than a year.

“It’s the most difficult business to quantify but broadly speaking, I agree with these figures,” said Jonathan Coulborn, of Thomas Coulborn & Sons. “For us, sales were up markedly in 2017 on the year before. I genuinely think it’s because there’s a marked rise in interest by people wanting to acquire good antique objects and furniture, for the purpose of making an interior rather than recreating a period room, as in the past.”

As for the time it takes to sell stock, Coulborn agrees “it’s slow to find the right customers for special objects, as you can only do a few fairs a year”. Ceramics and works of art dealer Alastair Gibson goes further, saying he suspects “the reality is higher in terms of years that dealers must hold on to stock”.

The good news for dealers of any size, and auctioneers too, is that online has become an increasingly important channel for attracting new clients, with online sales up 10% year-on-year (ATG No 2334).

“In 2017 we really saw a spike in the high end Dr Clare McAndrew founder of Art Economics

Supply always the issue

The report reinforces how highly concentrated the auction sector is in particular, with the top five auction houses accounting for around half of the global market by value.

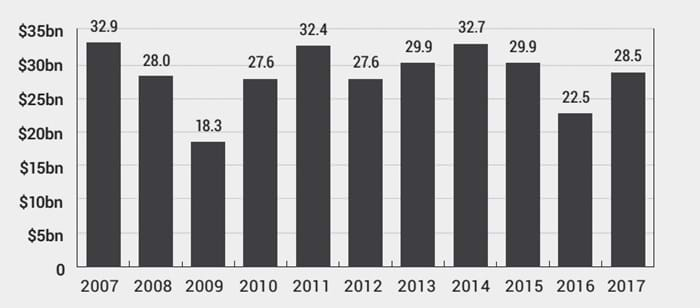

Sales at public auction reached $28.5bn, up nearly a third on the previous year. What will resonate with middle-market fine art auctioneers in particular is how post-war and contemporary remains the largest part of the market, though growth in this sector has tailed off, according to Art Basel.

UK auctioneers ATG spoke to are still keen to invest in specialists covering this area.

“We believe mid-century has some way to go,” says Lyon & Turnbull managing director Gavin Strang.

However, as McAndrew concludes: “We are at the mercy of what comes for sale each year.”

Global figures

$63.7bn

Sales in the global art market in 2017, up 12% from 2016

$12.9bn

The value of overall sales in the UK market in 2017, up 8% year-on-year

+27%

Year-on-year increase in value of sales at public auction of fine and decorative art and antiques, to $28.5bn

$33.7bn

Value of dealer sales in 2017, up 4% year-on-year

41%

The proportion of those buying online that were new business for second-tier auction houses; for dealers, 45% of online buyers were new clients

$5.4bn

The global online art and antiques market in 2017 – a new high and up 10% year-on-year

The global picture

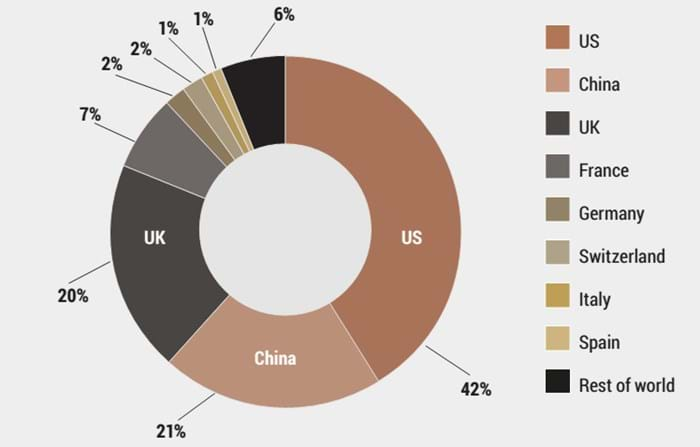

Global art market share by value in 2017.

Art Basel’s The Art Market 2018 report recorded a shift in the global hierarchy of the top three largest markets, which together account for 83% of total sales by value. The US continues to lead, increasing its share by two percent to 42% of world sales by value. China marginally edged ahead of the UK, thanks to strong sales and sterling’s weakness.

After two years of declining sales, the global market “turned a corner” with sales increasing to $63.7m, from across both auctions and dealer sectors, according to The Art Market 2018 report. The climate for sales at the top end was favourable, despite political volitility in key geographical markets such as the US. Premium market gains were topped by a historic record for a rediscovered Leonardo da Vinci, which sold for $450m. Both the auction and dealer sectors recorded increased sales, driven by the top end of the market, with the mid-market remaining stagnant.

Auctioneers and dealers

Sales at public auction of fine and decorative art and antiques reached $28.5bn in 2017, representing an increase of 27% on the previous year. The US accounted for 35% of these sales, according to the 2018 report, with China the second largest auction market at 33%, followed by the UK at 16%. From 2007 to 2017 growth was in the high end bracket, with the value of sales of works sold for more than $10m increasing by 148% over the ten-year period.

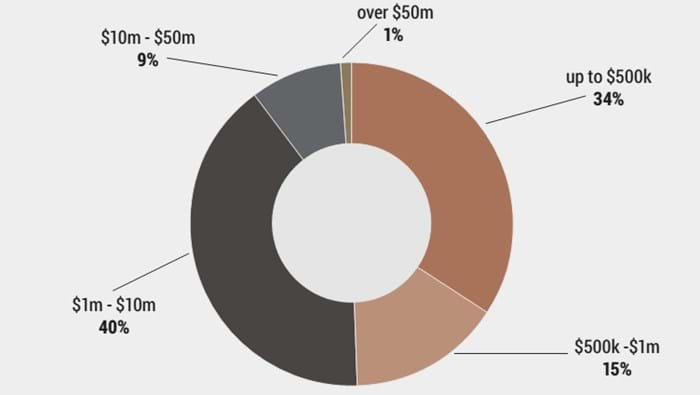

Share of surveyed dealers by total sales in 2017.

The report surveyed 6500 dealers across key markets in 2017. Dealer sales in 2017 reached an estimated $33.7bn, up 4% on 2016. Ten per cent of respondents had total sales over $10m and just 1% reported sales in excess of $50m.

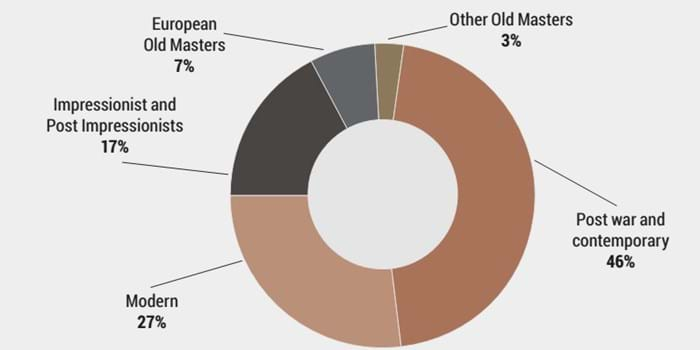

Market share by sector, fine art auction market in 2017.

Post-war and contemporary art was the largest sector of the fine art auction market in 2017, accounting for 46% of its value and 45% of the lots sold, according to the report. Growth in sales in this sector peaked in 2014. Sales of European Old Masters in 2017 diminished by 11% on the previous year, if the Leonardo da Vinci $450m sale in November 2017 is stripped out.

Average time taken to sell works from dealers’ inventories in 2016 and 2017.

Dealers were asked how long it takes to sell a work from their stock. The period of 6-12 months had the most responses (29%), a similar response to the two previous years. Those in the antiques and decorative arts sectors had the slowest sales cycles (30% within a year).