New reality at the top

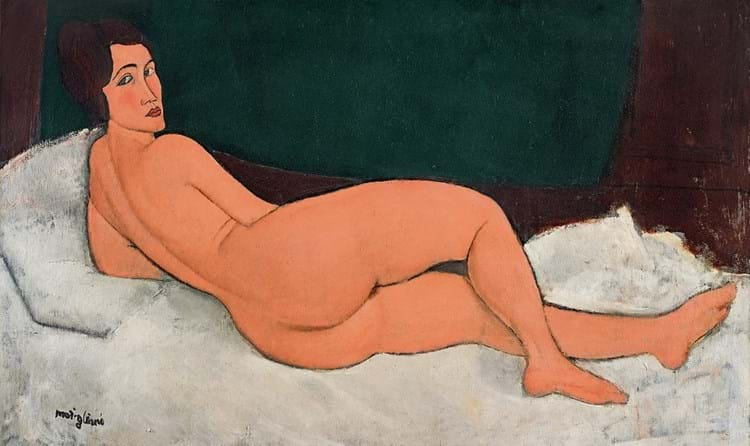

The art market is not always what it seems. In August, Sotheby’s CEO Tad Smith made the extraordinary admission that just two lots – a $139m Modigliani nude sold in May and a £24m Picasso portrait in June – had reduced the firm’s entire commission margin by 1.1% for the first half of 2018.

From the outside these had looked like big wins for Sotheby’s. But in the world of irrevocable bidders and price guarantees, a huge price is not necessarily followed by a huge profit.

When he took over the company in 2015, Smith promised discipline when it came to guarantees and a focus “on returns on invested capital and being careful with shareholders’ money”. Rolling the dice at Sotheby’s won’t continue.

Price guarantees had been anathema for former Bonhams owner Robert Brooks – a ‘red line’ the firm crossed only on a couple of occasions during his long tenure. Accordingly, eyes this year will be upon new owner, private equity group Epiris, to gauge its vision for Bonhams and the role it plays in the international art market.

Will the focus be on its traditional collecting heartland or will it try to break the duopoly operating at the tip of the art market? Perhaps Epiris’ first major appointment – Muys Snijders poached from Christie’s to head a post-war and contemporary art department in New York – answers that question. Bonhams’ commitment to online sales is also set to ramp up. Will it still need two London salerooms? It has already closed its lavish restaurant.

Change too at the top for Christie’s where the new year begins without some big hitters. “What an incredible ride it has been,” posted Francis Outred, chairman of post-war and contemporary art for Europe, on his last day in the office on November 30.

Loic Gouzer, his North American equivalent who is credited as the architect of the $400m sale of Leonardo’s Salvator Mundi, is also looking to new projects. At 45 and 38, neither is a veteran. The days of the ‘man and boy’ auctioneer with a job for life look numbered.

“The auctioneer offering the traditional ‘empty the rooms and put the keys through the door’ service is moving on

The regional landscape

Making a decent profit from buyer’s and seller’s premiums is not as easy as it seems – at all rungs of the auction ladder. Behind Moore Allen & Innocent’s decision to trial a £10 charge for condition reports on lots estimated below £100 (see ATG 2369) lay the quandary faced by every grassroots-level auctioneer.

Just how do you make money when the prices of so many traditional furnishings and chattels are so low? Moore Allen & Innocent’s solution has proved controversial but, if it works, the Cirencester auctioneer won’t be the last to try it.

Up and down the country weekly general sales have been disappearing from the calendar – perhaps a third of them in recent years – as auctioneers concentrate their energies higher up the food chain.

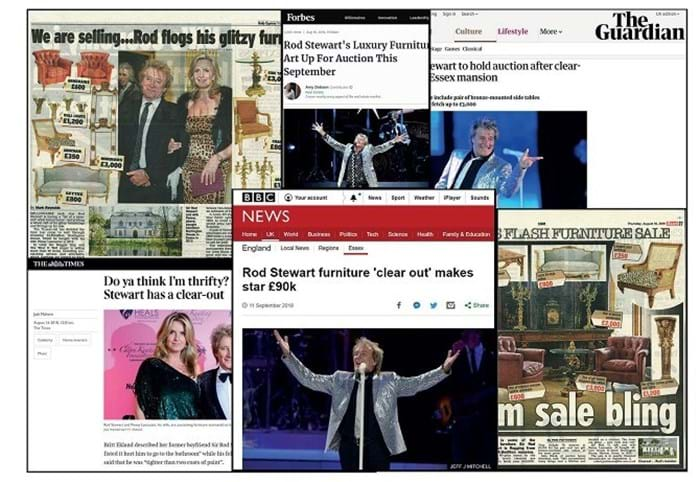

A firm such as Sworders is a textbook case study: fortnightly rather than weekly ‘interiors’ auctions, a repackaged calendar of ‘fine’ sales that demand specialists rather than generalists, an eye for a publicity-grabbing consignment and a London office in the pipeline for the new year with the aim of attracting more consignments up the M11.

A celebrity angle is sometimes necessary to bring an ‘antiques’ story to the wider media. Among the most-publicised events of 2018 was Sworders’ sale of furniture from the Essex home of Rod Stewart. Expect more celeb stardust to be sprinkled in 2019.

This evolution of the saleroom landscape is all good news for consignors of quality material: plenty of choice and deals to be done. But it does come at a cost for those with full house contents to clear. The auctioneer offering the traditional ‘empty the rooms and put the keys through the door’ service is moving on to the higher ground.

Green shoots

Of course, there will be room for everyone in the food chain if antique furniture can be appreciated not just as a repository of history, character and beauty but also as a product that is sustainable, reusable and resaleable.

It is 10 years ago (in June 2009) that Beaconsfield dealer Nigel Worboys launched the Antiques are Green manifesto. This sold the message that the carbon footprint of an object made a century or more ago is tiny compared to the products of 21st century industry: the stiletto rather than the steel-capped boot.

A decade later it could be that the media and the Great British public are now ready to listen – according to waste thinktank RSA, Britons still throw away more than 300,000 tonnes of furniture every year. It took TV’s Blue Planet and a 5p charge to change consumer behaviour when it came to plastic bags. “As environmental awareness grows, 2019 offers us the opportunity to capitalise on the message that antiques are green,” says BADA CEO Marco Forgione.

It is certainly a theme around which the antiques trade can coalesce.

When Antiques are Green launched in 2009, members of the antiques trade commissioned independent research to put a number on just how eco-friendly buying antiques can be. The report concluded the carbon footprint of an antique chest of drawers was one-sixteenth that of its modern-day equivalent. Was this initiative simply 10 years ahead of its time?

Botox for the trade

Plenty of noise in 2018 has surrounded the use of the new technology blockchain as a way to record the movement and provenance of works of art.

In the real world this is still in its infancy and destined to be expensive – and thus actionable only for high-value items such as the Ebsworth collection of American art that gave blockchain its first auction outing for a full group at Christie’s in November.

As Jonathan Kewley, lawyer at Clifford Chance, says: “I think blockchain will help the art market. Not a full facelift but maybe some subtle Botox.”

“The taste influencers of the day style homes with an eclectic mix of what they love. The buzzword is ‘century mashups’

Social life

Art and antiques has an advantage over others in the world of social media. The decorative arts lends itself so well to the visual post. But it’s not just about pictures or an insight into taste and ‘eye’. It can be a cost-effective way to increase sales and build a client database without the overheads associated with shop rent, galleries, stands or paid advertising.

More and more dealers and auctioneers are exploring selling directly through Instagram in particular, adding prices, captions and tags to posts and achieving good click-through to their own websites. The expectation is that Instagram’s role will expand further once a ‘buy now’ potential has been fully integrated to the platform.

Changing taste

Those who are successful on social media appreciate how the idea of the ‘period room’ has changed. Eclecticism – the mixing of styles and periods with aplomb – is no longer a movement. It is the norm.

As Freya Simms, LAPADA chief executive, puts it: “Previously interiors were strictly defined from a Georgian salon through to mid-century New York loft. Now all bets will be off as the taste influencers of the day style homes with an eclectic mix of what they love. The buzzword is ‘century mashups’.”

Asian expansion

Even with the occasional moment of stardust – a Leonardo discovery or a tie-up with a former Spice Girl – the market for Old Master pictures is subject to a slower pace of change. But, during the latest sales series in London in December, specialists noted a welcome trend.

Interest from the Far East – a feature of recent sales – had this year translated into hard cash. Sotheby’s senior director Andrew Fletcher told ATG that a private selling exhibition of Old Masters staged in Hong Kong during the September ‘Chinese’ art sales was “the most significant thing that we did in the year”. In total, 15 of around 40 works were sold.

The bulk of the buyers were Asian clients already active in other sectors, although one buyer was completely new to Sotheby’s. “Normally Asian clients buying Old Masters come in trickles,” said Fletcher, “here it felt like a sudden roll.”

One of the works offered at Sotheby’s 'A Brush with Nature' exhibition in Hong Kong included this view of the Seine by Jacques- Albert Senave (c.1758-1823). Overall 15 works were sold with prices at the show ranging from $25,000 to over $1m.

Christie’s Old Master specialists, meanwhile, said there was great interest in the sector from clients who attended a dinner they held in Hong Kong to promote its ‘Classic Week’ of auctions in London.

Having also exhibited highlights in Shanghai, Nanjing and Taipei they reported Asian bidding on one of the star lots – The Netherlandish Proverbs by Pieter Brueghel the Younger that sold at £5.4m – as well as two further Old Masters further down the price scale by artists who were “not household names”.

It is small steps but taking ‘Western’ taste to Far Eastern buyers is clearly paying dividends.

Asian buyers continue to broaden their horizons at UK regional sales and fairs – buying carefully in defined areas such as French clocks and furniture. Watching the South Korean, Japanese and Chinese spotters in action at IACF Newark is an eye-opener as containers full of British antiques head to the Far East.

Ivory confusion – or chaos?

Royal assent for the ivory bill has been given. Defra says the law is likely to come into effect in late 2019 (see page 6). ‘Sell it while you can or buy it now while you can’ is the message among those who trade in antique ivory.

If dealers and collectors have been dismayed at the strength of the ban – no doubt it is something close to the worst-case scenario that many feared – then the authorities may gulp at the deluge of paperwork on the way.

The practicalities of a 10% de minimis rule and the meaning of the phrase ‘the best and most important of their type’ will, at best, take some ironing out. So, too, a registration process that documents every teaset with ivory insulators and chest of drawers with ivory escutcheons. Expect confusion – or chaos.

There are already discussions around the so-called ‘unintended consequences’ of the elephant ivory ban – the effect it could have on other ivory-bearing species. The target list might get larger to include walrus, hippo, narwhal, sperm whale and (although extinct for four millennia) mammoth.

It was telling too that in November Sotheby’s and Bonhams chose to join Christie’s in not selling antique rhino horn – not because there was evidence of violations of the law but because more than 30 pressure groups joined in opposing the sale of a collection of Ming and Qing objects.

Provenance under scrutiny

It is often said that the art and antiques trade is unregulated. It’s not quite true. As well as impending laws surrounding cultural heritage, the Antiquities Dealers’ Association (ADA) has warned that “long-term damage is being inflicted on both the trade and museums” by the growing number of legal cases surrounding antiquities with long North American provenances.

This Geometric period bronze – one of more than 1000 known – was withdrawn from a Sotheby’s sale in May following an 11th-hour claim by Greece’s ministry of culture that it was ‘stolen’. Sotheby’s is taking court action alongside the object’s owners (the family of the late collectors Howard and Saretta Barnet) who bought it at auction in 1973. It was first sold at auction by Swiss firm Münzen und Medaillen in 1967.

A Geometric period bronze with a 1960s auction history was withdrawn from sale in May following an eleventh-hour claim by Greece’s ministry of culture that it was ‘stolen’. It joins the so-called ‘Guennol Stargazer’ (on American soil for over half a century) and a Persian limestone bas-relief seized from the stand of dealer Rupert Wace at TEFAF New York after nearly 60 years in a Canadian museum among the many antiquities that are now guilty until proven innocent.

A fear is that something similar could happen in the tribal art market. There’s no doubt that auctioneers and vendors are discovering that Europe’s country houses, furnished with the routine period objects that no longer generate great excitement, can occasionally yield valuable souvenirs of a colonial past.

As the artefacts of non-European cultures are now the subject of worldwide interest and appreciation, four UK regional salerooms now have a designated tribal art department to complement the annual Tribal Art London fair.

But – and there is a ‘but’ – with that comes more 21st century scrutiny.

In France and Belgium, where so much of the market is concentrated, the talk is of restitution. President Macron’s recently commissioned report on the repatriation of African artwork in French museums called for a change in heritage law. “There are historical explanations” for France holding African artworks, the French president has said, but there is “no valid, lasting and unconditional justification”.

Anthony Meyer, the Paris Oceanic art dealer, has a wish list for the future. “I would like the restitution situation be dealt with in a calm, thoughtful, open, bilateral manner and not in an aggressive, acrimonious, demanding fashion… dealers and museums have always shared,” he said.

Growing up

Last year was the moment some of the ‘adolescent’ markets that helped sustain the business in the early 2010s suddenly looked to have matured.

Sales of Chinese works of art and Modern British art will continue to evolve – the move in the latter is towards hitherto neglected post-war artists – but movements in the merchandise, the pricing and the buying audience are far more subtle than a decade ago.