Last year private sales of art and antiques flourished while auction sales contracted, according to the 2017 TEFAF Art Market Report.

Across the trade, the private transactions of dealers and auctioneers accounted for almost two-thirds of the worldwide market in 2016, the report released this week stated.

Total sales in 2016 were $45bn, up 1.7% on 2015, and dealer sales now make up 62.5% compared with 37.5% sold at auction.

The shift was put down to a greater desire for “privacy and anonymity… in times of austerity and political tensions”.

The report also said the dealer market is “benefiting from buyer confidence stemming from greater access to information and transparency on prices”.

The 2017 report is the first managed by Professor Rachel Pownall, following previous author Clare McAndrew’s departure for Art Basel in 2016.

It brings a new methodology designed to focus more on the trade (see below).

“I wanted to start from scratch with this report and not just follow what Clare had done, ” Pownall told ATG.

The report found that in 2016, global auction sales totalled $16.9bn, down 18.8% from $20.8bn the previous year. In contrast, dealer revenues in the same period increased by 20-25%.

A major reason for the decline in auction sales in 2016 was the drop in the number of lots consigned as potential sellers held back amid uncertainty.

In the UK, where sale totals fell by nearly a quarter, the volume of consignments was down 19.4%.

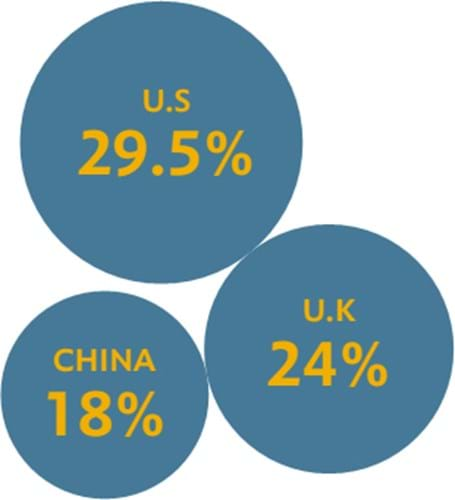

With fewer high-value works on offer, the US suffered a startling 41% fall in auction revenues, but remains the largest art market overall in the world with a 29.5% market share.

The UK retained its second place with an estimated 24% of the market. China declined to 18%, down from 19% in the previous year and down from 22% in 2014 when it was the second largest art market.

The report is published this week to coincide with the opening of the TEFAF Maastricht fair on March 10.

TEFAF report: A new methodology

After economist Dr Clare McAndrew, who had led the research for eight years, left in 2016, the authorship of the TEFAF report has changed and its methodology tweaked. This year’s report has been put together by Prof Rachel Pownall of the School of Business Economics at Maastricht University in partnership with the Maastricht Centre of Arts and Culture, Conservation and Heritage (MACCH).

It uses aggregated data from Artnet’s database of 1700 auction houses, which Pownall says represents 95% of the auction market by value. The report also surveyed 5000 dealers, but used a narrower research scope for a more “representative sample of the industry” and to reflect TEFAF fair exhibitors: those selling objects above $500.

It compiled data on dealers and galleries from national statistics offices, financial data from Orbis, a global company database, and Maastricht University’s annual dealer survey.