Although this market has certainly struggled to compete against the huge investment gains of the later art periods, a recent sale of high-end 19th century works at Sotheby’s (25/20/12% buyer’s premium) in London suggests appetites may be tempered but not satiated just yet.

The star lot, Vilhelm Hammershøi’s (1864-1916)White Doors, was secured at £1.2m by the Ordrupgaard Museum in Copenhagen, underbid by collectors from six other countries (see ATG No 2296). The artist’s “timeless aesthetic, inspired by the Old Masters but at the same time anticipating modernist minimalism” has made the Dane popular among collectors from across categories, said Claude Piening, head of Sotheby’s 19th century European paintings department.

“The market continues to become more selective, defined by star lots of the highest quality, that are rare, and have an excellent provenance, whether it be William Bouguereau’s Young Shepherdess that sold at Sotheby’s in New York in May [$1.32m including premium], Eugène Delacroix’s rediscovered Growling Tiger in Paris [€931,500 including premium], or White Doors.”

French records

In all, the select 70-lot sale on June 6 posted a £4.48m total with 70% getting away. Piening reported ‘strong’ bidding and underbidding from across Europe, North America and Asia.

A handful of lots produced sluggish results, including Joaquin Sorolla’s (1863-1923)Greek Girls on the Shore, which failed to reach its bottom estimate and scraped away at £570,000.

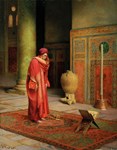

Jean-Léon Gérôme’s (1824-1904) well-known canvas Bethsabée had once fetched $2m at Sotheby’s New York in 1990, but had decreased dramatically in value since then, selling at Sotheby’s in 2005 for £400,000. It was again knocked down here to the trade for the same sum 11 years later.

Instead, the sale’s stand-out lots came from recognisable views of Paris and Venice, with two new records for French contemporaries Luigi Loir (1845-1916) and Edmond Grandjean (1844-1908).

Loir’s dramatic panorama of the Paris World’s Fair of 1900, described by Sotheby’s as “without doubt one of the most remarkable and monumental works” by the artist, sold to a private collector on top estimate at £180,000 – nearly £100,000 above his previous record set in France in 1998.

Loir painted Les Quais de la Seine from the Pont Alexandre III bridge, picking out domes of two of the foreign pavilions: the towers of the Palais du Trocadéro and the hazy tips of the Eiffel Tower. The vast 4ft 11in x 9ft 10in (1.5 x 3m) oil on canvas had been acquired by the vendor in 1983 from French dealer Didier Aaron.

Grandjean’s more modestly sized 2ft 6in x 4ft 2in (77cm x 1.26m) oil on canvas of a sunny vista along the bustling Boulevard des Italiens had not been on the market since 1982.

Depicting one of Paris’ four grands boulevards, The Boulevard des Italiens was painted in 1876 and exhibited at the Paris Salon that same year.

Despite selling below the £200,000-300,000 guide, it still established a new record for the artist at £190,000 from an anonymous buyer. The previous high had been the $110,000 paid at Christie’s New York in 1984 for a later Boulevard des Italiens view of 1889.

Looking elsewhere

Elsewhere, Guglielmo Ciardi’s (1842-1927) veduta of the Venice lagoon soared above its estimate of £60,000-80,000 and sold to the European trade at £170,000.

Also selling were pictures with impressionistic qualities by artists who worked closely with the Impressionists themselves, including Giuseppe de Nittis (1846-1884) and Federico Zandomeneghi (1841-1917).

A couple dressed in the latest Parisian fashions and out on their morning ride along the Avenue Foch are painted in Nittis’ L’Arc de Triomphe, Paris. Behind rises the famous landmark clad in wooden scaffolding as it underwent repairs on damage inflicted during the Franco-Prussian War.

The 21 x 16in (53 by 40.5cm) oil on canvas, which had once been owned by the soldier and collector John Glas Sandeman (1836-1921), sold at Bonhams New York in 2009 for a premium-inclusive $1.13m (around £680,700). In London, it was secured below a £500,000-700,000 estimate, at £450,000.

Greater demand emerged for Zandomeneghi’s La Curiosité, an 18 x 14½in (46 x 37cm) oil on canvas that had not appeared on the market for over half a century.

Executed in the artist’s unique painterly technique, a blend of impressionism and elements of pointillism, the portrait depicts a young girl discreetly peeking through a lifted curtain, while delicate pastel shades of colour bring to the fore her youth and purity.

The female figure became predominant in Zandó’s oeuvre from 1894, a year that marked a turning point in his career. Helped by its fresh-to-market status, it sold on top estimate at £200,000.

19th century market factfile

ATG’s quick-fire questions with Claude Piening, head of Sotheby’s 19th century European paintings department.

Claude Piening, head of Sotheby's 19th century European paintings department.

What is the biggest challenge facing the 19th century pictures market?

Supply. Provided we can offer the market great pictures, it continues to be very responsive.

Many great pictures are now spoken for in this mature market (by collectors and museums) and supply is therefore limited.

How would you respond to those who say 19th century pictures are unfashionable?

Clearly there are certain subjects, especially the sentimentalising anecdotal ones, that are slightly yesterday’s taste, but equally the 19th century remains an incredibly exciting collecting area in terms of quality and diversity.

In fact, it is not a market but multiple artists governed by regional as well as international interest, with artistic movements from the German Romantics to the Belgian Symbolists, from the Spanish Impressionists to the Scandinavian Modernists. For potential collectors who look more closely, there is something for everyone.

In the London sale was there any evidence of wider market trends coming into play, such as a weakened sterling?

While weak sterling is helpful to buyers from the dollar and euro zones, our market is driven primarily by the works on offer. Great art sells regardless of the vagaries of the exchange rate.