Stanley Gibbons Group proposes to de-list from the London Stock Exchange.

Phoenix Asset Management, which holds a 58% stake in the group and provides all its debt facilities, said there are “clear benefits” to ending the listing but warned it would “reconsider its continued financial support” for the group if the delisting did not go through.

Phoenix argued that cost, time and the burden of regulatory requirements as a listed company were “disproportionate” to the benefits.

It must gain 75% support from its shareholders to cancel its shares on AIM.

If the proposal is approved it plans to delist on September 7.

New CEO

Also announced today, the group said its chief executive Graham Shircore will step down on September 12 to return to work at shareholder Phoenix and Tom Pickford will take over the role. Pickford previously worked at The Hut Group and Procter & Gamble.

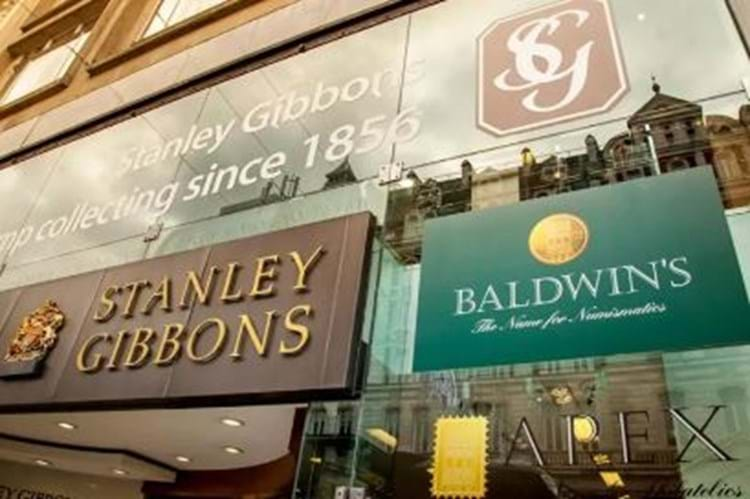

Stanley Gibbons Group was founded in 1856 when Stanley Gibbons opened a stamp counter within his father's chemist shop in Plymouth.

The firm listed in 1990s and in 2013 bought Noble Investments, taking over the dealership Baldwin's and auction houses Dreweatts and Bloomsbury. In 2014 it bought furniture dealership Mallett.

By 2017 it decided to sell some of these acquisitions and art consultancy and valuation firm Gurr Johns bought Dreweatts and Bloomsbury and then bought Mallett by early 2018.

According to The Financial Times Stanley Gibbons shares have fallen 81% since 2016.