The new statistics – issued to mark the 10th anniversary of ARR – show that the total receipts have more than tripled since 2012 when the levy was extended to allow heirs and estates to profit from ARR up to 70 years after an artist’s death.

The data provided to ATG by the two main collecting agencies in the UK has shown a dramatic growth in payments over the last five years.

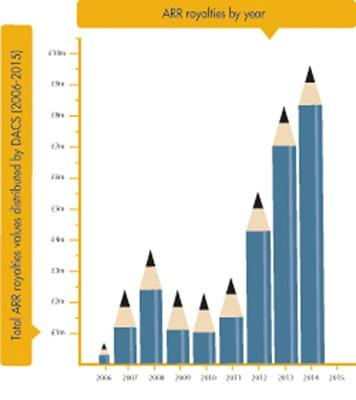

The Design and Artists Copyright Society (DACS), the largest collecting agency for ARR in the UK, say they distributed a total of £46.9m in ARR royalties over the last decade. The amount paid in 2015 was £10m, up from £2.7m in 2011 – the large jump primarily down to the extension in January 2012 and the growth in the number of works selling above the €1000 threshold.

DACS forecasts that the ARR revenue is set to increase again in 2016.

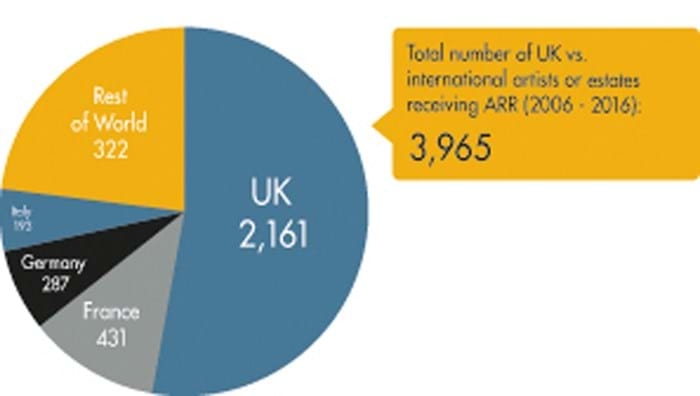

In a white paper released last week, DACS state that over 3900 artists and artists’ estates have received payments from them since ARR’s inception.

With UK Modern, Post-war and Contemporary art sales totalling €1.85bn in 2014, DACS say the ARR royalties collected represents 0.64% of the total market spend.

However, Dr Clare McAndrew of Arts Economics, whose statistics are quoted in the paper, told ATG that her data had been used “in extremely selective ways” and that the UK had actually lost global market share in both the Contemporary and Modern sector since 2006.

Figures from the UK’s other collecting agency, the Artists’ Collecting Society (ACS) set up in 2006 by Harriet Bridgeman, showed they distributed £1.49m in 2015, up from £1.15m in 2014.

ACS administer ARR on behalf of artists and artists’ estates that have specifically mandated them to do so but have now grown to represent over 1000 artists.

Since 2006, they have paid out some £6m in royalties.

Auctioneer’s View

Philip Smith, Mallams, Oxford:

“There was a lot of antipathy and worry about how ARR would affect the trade when it was first brought in. Auctioneers have got used to it now, but the cumbersome administration and issues over technicalities have been more of a burden.

“Sometimes it’s difficult to know what constitutes an applicable work of art – for example, we have to determine whether a ceramic or glass work was produced under the artist’s guidance or by their actual hand.

“Also, when does ARR come into play when the price is on the cusp of the €1000 threshold? Should you take the exchange rate at the start of the day, end of the day or the time when the lot is offered from the rostrum?

“With two collecting societies we have had occasions when both societies try to collect for the same work. We’ve also received money back from DACS when they haven’t been able to trace the heirs.”

Dealer’s View

Rene Gimpel, Gimpel Fils Gallery, London:

“The British art market continues to flourish under ARR, even attracting major names from countries outside of the ARR remit.

“The art trade is now seen in a more positive light by artists and artists’ estates.”

In Numbers

63 - The average age of living artists who received ARR royalties last year was older than expected, suggesting the main beneficiaries are established names and their heirs.

15% - DACS charges a 15% administration fee on royalties arising from UK art sales.

2 - The number of ARR payments made when a dealer buys an applicable work at auction and then sells it to a client. Dealers regularly complain that they are ‘charged at both ends’.