In the sale given the title of 'Taubman Masterworks' on November 4, the market reacted somewhat unfavourably to hefty estimates as six of the top ten lots went for sums below the low end of expectations. The overall hammer total was $326.1m (£221.8m) against a $375m-527m pre-sale estimate.

While 69 of the 77 lots found buyers on the night (90%), there was speculation whether the rumoured $500m guarantee given to the heirs of Sotheby's former owner would mean that selling the most valuable single-owner collection in history could end up being unprofitable.

The guarantee, by far the largest in auction history, followed strong competition from Christie's to win the consignment.

After the sale, Sotheby's president and CEO Tad Smith said he was "comfortable" with the night's results, and that with more than 400 works still to be sold, Sotheby's were "on track to cover most of the total guarantee". He emphasised that "both the hammer and buyer's premium count towards the guarantee".

The total including buyer's premium was $377m (£256m) and the remaining auctions of the Taubman collection are likely to achieve an overall total beyond the €373.9m ($483.8/£332.8m) generated by the Yves Saint-Laurent-Pierre Bergé Collection sold at Christie's Paris in February 2009, the current auction record for a single-owner collection.

Leading Modigliani

At Sotheby's, the 'Taubman Masterworks' sale was led by Amedeo Modigliani's Portrait de Paulette Jourdain from 1919, a painting which the shopping-mall magnate bought in 1983, the same year he acquired the auction house itself.

Here, the estimate was in excess of $25m but a bidder in the room and another on the phone took it up to $38m (£25.8m) before it was knocked down to the latter, an Asian private buyer.

Taubman, who died in April aged 91 after a heart attack at his home, remains a pivotal but controversial figure in the auction business, having been the only person handed a prison sentence for his role in the price-fixing scandal in 2002.

A self-made billionaire from Michigan, he took Sotheby's back into public ownership in 1988 and oversaw the development of the premises in New York where the current auction was held.

As well as a further sale of Modern and Contemporary art which raised $42.7m (£29m) on November 5, Sotheby's are staging auctions of American art on November 18 and Old Masters on January 27 which all comprise works from the Taubman consignment.

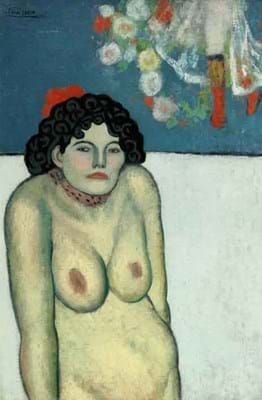

Meanwhile Sotheby's mixed-owner Impressionist & Modern art evening sale on November 5 generated $306.7m (£208.6m) with 36 of the 47 lots selling on the night (77%). The sale was led by Pablo Picasso's La Gommeuse from 1901, which took $60m (£40.8m). It came from the collection of American energy magnate William Koch and sold to a private collector bidding through a Swiss dealer.

Christie's, meanwhile, are holding both their Impressionist & Modern art and Contemporary auctions in New York this week. Among the highlights is Modigliani's Nu couché from 1917-18 which is estimated in excess of $100m.

The buyer's premium was 25/20/12%.

ATG Comment

As a public company Sotheby's are at a disadvantage when it comes to guarantees. They have to take into account shareholder value and tell the market whenever an extension to the credit line is required.

In the case of the Taubman sale, an extra $200m of borrowing was required shortly after the guarantee was made. This, coupled with huge marketing costs and the lukewarm results from the first two sales, suggests that Sotheby's will do well to break even on the deal.

But this was, of course, as much about market share and face-saving as about profit making. The level of the guarantee implies Sotheby's went to great lengths to avoid the embarrassment of seeing works amassed by their former owner being sold elsewhere. This was the sale that Sotheby's couldn't afford to lose.