The terms of the sale were confidential, but the private treaty deal brokered by Bonhams brings a welcome end to more than two years of uncertainty for the Ruislip auctioneer, and the market in general, after he brought the hammer down at £43m in a blaze of publicity.

Bonhams also confirmed that they had negotiated the deal which is thought to be with a new buyer, a Far Eastern collector.

As readers will doubtless remember from the acres of newsprint and hours of broadcast time devoted to the story, what was for a short time the highest price ever recorded at auction for anything other than a painting or piece of sculpture came on the evening of November 11, 2010 as lot 800 was placed before the rostrum in a warehouse auction room just off the A40 to the West of London.

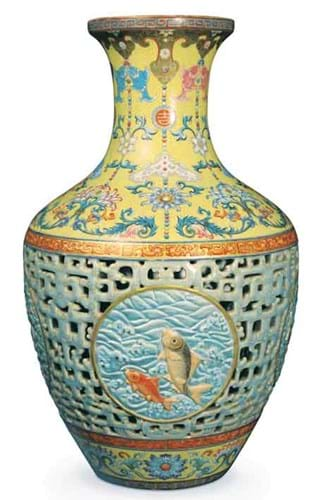

The 16in (41cm) yang cai reticulated double-walled vase with famille rose decoration, that was to draw bids from a queue of the world's top dealers and collectors, had been consigned by retired solicitor Tony Johnson after being discovered while clearing his late aunt's bungalow in Pinner.

The vase was deemed to have been a commission for one of the palaces of the Qianlong Emperor (1736-95), probably the Summer Palace or the Forbidden City.

Seasoned dealers and collectors in town for Asian Art in London patiently queued along Dover Street three days before the sale when Mr Bainbridge brought the vase to the capital to be viewed.

The consensus was that it was the best object of its type to be seen on the market in decades. Its discovery also coincided with the height of the Chinese buying boom, and its craftsmanship and importance could not have appealed more to Chinese collecting tastes.

Trade Value

Perhaps the best indication of the vase's true market value was that trade bidding at the original auction remained active until around the £22m mark, after which the competition was reduced to two bidders, both thought to be agents in the room for Chinese collectors.

Bloomberg News reported the value of the Bonhams deal at between £20m and £25m.

The successful bidder at Bainbridge's is thought to have balked at the £8.6m buyer's premium on the vase. However, securing payments from Chinese bidders in general was already recognised as a fairly widespread problem at the time.

Months later, with no confirmation that the sale had been completed, the speculation began.

Mr Bainbridge, who remained tight-lipped about what was going on, was quoted in his local paper, the Uxbridge Gazette, in March 2011, as saying: "The buyer is completely legitimate, with no ulterior motives. The sale is going through and is completely within the time-frame we are comfortable with."

Later there were reports that Mr Bainbridge and the vendor had flown to China in attempt to secure payment.

Legal experts consulted by ATG over the issue raised a number of points that indicated Mr Bainbridge's options over what to do next would have been limited. One barrier to a successful conclusion was the question of the buyer's premium.

One expert opinion was that to reduce it, or scrap it altogether, would have been unfair to the underbidder, who might well have argued that they would have been prepared to go higher had they known that a discount would be on offer later.

Bainbridge's went on to enjoy more straightforward success in the Chinese works of art market when they took £1.4m for a Xuande (1425-1435) blue and white dice bowl and £850,000 for a Hongwu (1368-1398) copper red bowl from the Gertrude Harriman collection in May last year.