With its teetering skyscraper of 11 separate catalogues containing over 1450 lots, Sotheby's, Christie's and Phillips de Pury's May series of New York sales represented the most ambitious test yet for the booming Contemporary art auction market.

Remarkably, despite the enormous quantities of art coming onto the market, demand continues to keep up with supply.

Sotheby's, Christie's and Phillips de Pury all sold over 90 per cent of the material at their marathon Part I evening sales. The overall total of $439.4m (£251m) achieved at all the auctions held by the three main houses (excluding results from Phillips de Pury's May 12 Part II sale, which was not available at the time of going to press) was an 11 per cent increase on the $396m turned over in New York in November.

Thanks to the extra input of Phillips de Pury (who are soon to open in London) and some highly lucrative Part II sales, Contemporary generated a broadly similar total to the $456.9m (£261m) achieved the previous week by Impressionist & Modern art, albeit from more than double the number of lots.

Though nothing could compete with the extraordinary $85m (£48.3m) paid the previous week for Picasso's Dora Maar au Chat, there were plenty of one-off results that bore out the post-sale assessment of Sotheby's Tobias Meyer: "People bid according to their wealth, not the market."

Much of this wealth was being splashed out by New York dealers thought to be bidding on behalf of mega-rich Wall Street hedge fund managers, who are currently investing heavily in what they judge to be the most bankable names.

This, in turn, has encouraged other dealers and collectors to consign major works - at a price. At Sotheby's near sell-out May 10 evening auction, the Manhattan dealers L&M Arts had to pay $14m (£8m), more than double the $6.5m low estimate, to see off four other bidders for the 1975 Willem de Kooning abstract Untitled XVI.

But other big-ticket items failed to generate excitement. Sotheby's were rumoured to have given the New York dealer Joseph Helman a guarantee of $17.5m to consign Roy Lichtenstein's large 1964 canvas, Sinking Sun, but this sold, again to L&M Arts, for $14m (£8m), adding another $3.5m to the auctioneers' spiralling annual costs.

The above-estimate final total of $128.7m (£73.5m) was nonetheless a record for Sotheby's and ten new artists' records were achieved.

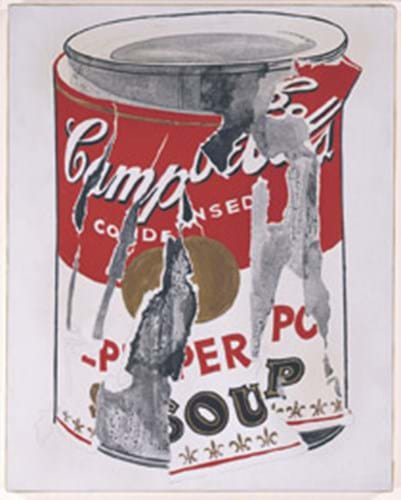

The previous evening Christie's had also gambled with some hefty guarantees, which by and large paid off. The Los Angeles dealer Irving Blum was rumoured to have been guaranteed around $10m to part with his 1962 Andy Warhol, Small Torn Campbell's Soup Can (Pepper Pot), which sold to the Gagosian Gallery for $10.5m (£6m). Even riskier appeared to be the $20m that Christie's were reported to have guaranteed the Donald Judd Foundation for the privilege of selling 26 works by the master Minimalist, mostly from the 1980s and '90s. Despite these pieces being relatively late, all of them sold and the final total of $24.4m (£14m) was well ahead of expectations. The prices of classic Minimalist pieces, which for so long have lagged behind Abstract Expressionist and Pop art, look set to rise.

Christie's evening total of $143.1m (£81.7m) was the second highest for a sale of Contemporary art and their Part II sales weighed in with a further $62.5m (£35.7m), with even here 90 per cent of lots successfully finding buyers.

For the moment at least, the strength in depth of the Contemporary market is truly extraordinary. But keep an eye on those hedge fund managers. They have a reputation for leaving markets even more quickly than they enter them.

By Scott Reyburn