For the third year running Dreweatts is the UK’s leading ‘regional’ auction house. The Newbury and London operation posted a January to December hammer turnover of £31.15m, a record for any provincial saleroom.

Equivalent sales for the firm, owned by art consultancy and valuation specialist Gurr Johns since 2017, were £25.7m in 2022 and £27.7m in 2021.

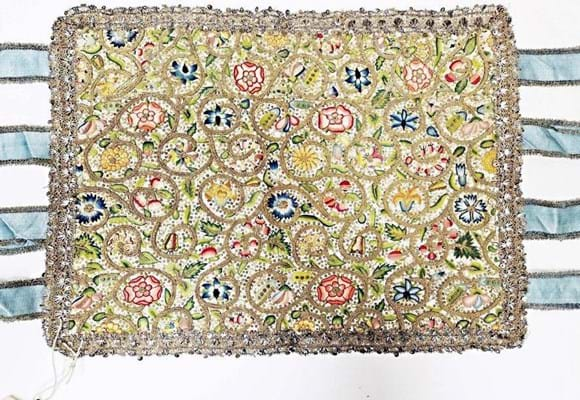

Providing a significant percentage of the uplift was October’s three-day auction titled Robert Kime: The Personal Collection that realised £7.65m from 715 ‘white glove’ lots. It included Dreweatts’ top lot of the year, a 17th century portrait hammered at £400,000.

Kime was one of seven single-owner ‘country house’ sales conducted by the furniture department that (together with four Fine Furniture sales) turned over £17.7m. Wine and spirits also proved an important area for growth. With over £2.5m in sales during 2023, it was up by just over 50% year-on-year.

Dreweatts has experienced a remarkable turnaround in fortunes since it was purchased from the Stanley Gibbons group for £1.25m in 2017 when annual sales were around £12m. Since August 2018, the firm has been overseen by managing director Jonathan Pratt. However, he has now left the company to pursue other opportunities.

Late 19th century red leather armchair by Howard & Son, regarded as ‘an old friend’ by Robert Kime, was sold for £45,000 at Dreweatts.

Currently, Will Richards, director of business development, is acting managing director. “We are delighted to have had such a strong performance across all our auction businesses in an otherwise subdued market”, he said.

Also part of the Gurr Johns group is the books and works on paper specialist Forum Auctions. It delivered hammer sales of £11.6m in 2023 against £12.5m in 2022 and £17m in 2021. Turnover from prints and editions again dropped in response to the ‘correction’ in the market for Banksy prints. Books auctions showed a modest increase in turnover year-on-year.

The two businesses are enjoying some of the synergy hoped for when Forum and Dreweatts merged in 2022. Forum director Rupert Powell said: “A notable feature of 2023 was the increased supply of traditional country house treasures uncovered by our colleagues at Dreweatts. We greet 2024 with a full auction calendar including two US-originated single-owner sales in the first quarter.”

Dreweatts and Forum delivered a combined hammer total of around £42.8m across 124 auction events offering 37,402 lots in 2023. Taken together, Dreweatts and Forum sold 63 lots at £50,000 or above (against 49 in 2022) with additional private treaty sales of £814,350 raising premium-inclusive turnover to £54.6m, a 12% increase on 2022.

Strong in Salisbury

Woolley & Wallis, the leading UK regional firm for much of the past 20 years, also enjoyed a strong year.

The hammer total for the 12 calendar months in Salisbury was a record £24.17m – improving on the previous highwater mark of £23.4m in 2010 when a consignment of imperial jades made £9m.

Most departments were up on 2022 or achieved very similar numbers. Items from the family of Adolphe Stoclet and the Murray Lawrence collection of jades were particular highlights. A white jade bamboo vase (£550,000) and a Victorian emerald and diamond bangle (£500,000) brought the year’s top-selling lots.

This silver and malachite table service by the Wiener Werkstätte was designed by Josef Hoffman for the Palais Stoclet in Brussels, c.1905. At Woolley & Wallis in June the seven-piece set sold in four lots to a single buyer for £505,000.

Chairman John Axford said: “The market is increasingly selective, and inevitably affected to a degree by worldwide events; but the core remains healthy and regular buyers are still actively bidding.”

He added that the firm is particularly proud of its trainee valuer scheme launched in 2021. “It has proved a success and we are always on the look-out for other talented young valuers who no longer have the benefit of the external training I and many of our senior specialists benefited from.”

Most auctioneers noted a softening in parts of the market with some of the price spikes experienced during the Covid lockdowns now a distant memory.

However, some of the lift provided by a new generation of buyers via the internet remains as does the focus of the major London houses on the highest-value lots, which is aiding the consignment flow to regional firms.

Adding to that in the last 12 months was the sense that, as some fairs at the middle and upper levels of the market have struggled to survive, more business is moving from the antiques shop to the auction room.

‘Good and rare sell well’

Lyon & Turnbull’s hammer total of £17.5m was a few percentage points down on the previous year. The company had posted £19.5m in 2022 and a record £21m in the lockdown year of 2021.

Managing director Gavin Strang said: “There was certainly a cooling in the market last year and some categories were a bit more ‘sticky’ than before, especially at lower price points. Good and rare things continued to buck trends and sell well however.”

The firm’s top lot of the year was a Colourist oil – Francis Cadell’s Still Life with Tulips hammered for £320,000 in June – and Scottish art contributed almost £3m across two designated sales. Strang said that made L&T market leader in that category for the second year in a row.

New for 2024 will be a designated Indian & Islamic auction in May in London (a well-known collection is already consigned) and a Classical & Ancient Art sale, which will be on view in Cromwell Place, London, in March.

Fresh sales formats

In 2023, Fellows averaged about 1000 lots of jewellery per week, most sold in timed online-only auctions.

The auction house did not provide ATG with a hammer total.

Underpinning its performance were the familiar strengths of vintage and contemporary branded pieces and a continued appetite for untreated coloured stones. Two contrasting lots sold for £90,000 in April: a Kashmir sapphire ring and a Grand Tour ring with a garnet intaglio of the emperor Augustus that flew way above the £150-200 estimate.

Fellows’ handbags department has grown and sales will become bi-monthly in 2024 while a new stand-alone category for February 29 is a Monies, Medals and Militaria auction.

Overall softening

This commessi di pietre dure panel from one of the Grand Ducal workshops’ most celebrated commissions far exceeded expectations at Roseberys’ Fine & Decorative sale, taking £265,000. The capriccio of Venice in cut stone was catalogued as 19th century but research showed it was made in Florence, c.1750-60.

“Since around June we have experienced an overall softening in the market across most genres, and the top of the middle market remains hugely competitive in regard to securing consignments”, said joint managing director Vicki Wonfor of Roseberys in south London.

“Internally, 2023 also saw a huge focus on compliance and the streamlining of onboarding clients. For 2024, we are working on advancements in the post-sale process to provide clients a more complete experience.”

Roseberys declined to give a headline figure but said its total hammer remained consistent with the results of the previous year, producing a slight drop of 2% in hammer.

The paintings and prints department hammered a record £4.62m with the Asian and Islamic department also proving a significant middle-market player at £3.36m.

Auction highlights included a Florentine panel from the Grand Ducal Workshops, knocked down at £265,000, and a modern Indian painting by Syed Raza that hammered for £240,000.

Taxidermy record

Tennants’ top price of the year was the £220,000 bid for this cased pair of extinct New Zealand huia, a record for a single piece of taxidermy.

Tennants in Leyburn, North Yorkshire, held 80 sales in 2023 and sold over 36,000 lots with a total hammer price of £14.1m and an 89% sold rate. It was the firm’s second-highest aggregate.

Helped by Lowry’s The North Sea for £840,000, the hammer total in 2022 had been £15.2m, compared to £12.8m in 2021 and £9.9m in 2020. The firm continues to invest in its specialist departments – six jewellery, watches and silver sales generated £2.6m – with the top price of the year, a cased pair of extinct New Zealand Huia sold for £220,000, posted in a September Natural History and Taxidermy auction.

Goal of £15m

The 12 months at Sworders in Stansted Mountfitchet, Essex, yielded sales of £12.2m, up from £11.75m. “We are edging up towards our goal of £15m”, said chairman Guy Schooling.

“In 2023 we sold more named private collections than ever before. Undoubtedly at the top of this list was the Guinness Sale at Elveden in September but – from a cache of photographs by Victorian author Lewis Carroll to further items from the collection of Sir Rod Stewart – we have relished every opportunity to tell a good story. It seems to me that as the market tightens, provenance and presentation is becoming ever-more important.”

The firm’s top lot of the year came from the Asian art department with a Qianlong zitan ‘dragon and phoenix’ box selling for £110,000 in November.

Schooling added that “the market for more ordinary pieces, typically those priced below £1000, is more difficult” as the cost-of-living crisis bites. “A client with £500-1000 ‘spare’ chose to spend it during the pandemic. Now they will hang on to it to cover the heating bills and the mortgage. A client proposing a £5000 or £50,000 purchase will probably not worry about such things.”

Hitting the ground running, the firm began 2024 with the Dick Turpin collection (raising £406,000 on January 25). Two other single-owner collections, from dealer Warner Dailey and the contents of an Eaton Square apartment, are already scheduled.

Austen letter

Fine art sales at Cheffins of Cambridge totalled £11.5m – the same figure quoted by the Cambridge auction house in 2022. The figure includes a private-treaty sale of a letter by Jane Austen discovered during a routine valuation in Cambridge. It went to Jane Austen’s House in Chawton, Hampshire, through the acceptance in lieu scheme to settle £140,000 in tax.

The firm’s best result from the rostrum was a Turner watercolour of Chepstow Castle sold for £75,000.

Charles Ashton, director of the fine art division, said: “The market remained strong throughout 2023 and each auction attracted record numbers of new buyers.”

Another private-treaty boost

At Duke’s in Dorchester sales were on par with the previous year at £8.5m, with an additional £2m achieved in private-treaty sales.

It was a pleasing outcome as 2022 had included the ‘windfall’ of two substantial house sales. The selling rate across just under 20,000 lots was up at 82% with the auction house reporting a competitive online bidding environment and more buyers from the US.

The top lots in 2023 came for 20th century art and sculpture – a bronze ‘maquette’ for Oscar Nemon’s statue of Winston Churchill in the Members’ Lobby of the Palace of Westminster selling for £200,000 in April.

With the creation of a London office on Hans Road and two specialist hires in the last three months, Duke’s has set a calendar of 34 auctions in 2024, the first standout event being the auction of the contents of Sandford Orcas Manor in March.

Banksy bonus

McTear’s of Glasgow achieved sales of £5.5m, a fraction up on the previous year with the sell-through rate also rising narrowly up to 83%. The auction calendar ended on a high with the Banksy screenprint Agile selling for £50,000 in December.

Mercury rises

This bronze figure of Mercury took a remarkable 1571-times top estimate at Reeman Dansie in August. The sculpture of the Roman god of commerce was bid to £550,000 against an estimate of just £250-350. It is believed to be a north European Mannerist sculpture possibly by Caspar von Turkelsteyn (1579-c.1648).

Colchester firm Reeman Dansie continued a run of good form in 2023, with sales also totalling £5.5m, repeating the 2022 total.

Sales were boosted by a house-record lot: the Mannerist bronze of Mercury which awoke from a four-figure estimate to bring £550,000 in August. Reeman Dansie sold many of its lots in the timed auction format that is becoming increasing popular for merchandise in the lower price brackets.

Two new salerooms

Retailed by Stoniers of Liverpool, this Tuscan China 16-piece bone china tea set was made for use in the VIP quarters on the Cunard ships the Queen Mary and Queen Elizabeth. It sold for a surprise £12,600 at Adam Partridge in Liverpool on December 6.

With the addition of two new salerooms, Adam Partridge also posted his best aggregate yet with sales totalling £6.7m. This compared to sales of £5.2m in 2021 and £6.4m in 2022. Total sales at the Macclesfield branch were £3.9m (down from £4.9m in 2022) with Liverpool marginally up on the previous year at £1.47m.

However, the acquisition of Bainbridges in Ruislip, west London, and a small auction house in Hele, Devon, are beginning to bear fruit. Both since rebranded, Adam Partridge London – now led by 19-year-old Ridley Partridge – held a dozen sales totalling around £820,000 while Adam Partridge Southwest generated a further £510,000.

“The London saleroom is particularly pleasing”, Adam Partridge told ATG. “Ridley and his small team are absolutely loving it and learning very quickly so my visits are likely to decrease this year. For them to do over £800,000 in year one is fantastic.

“I am very proud of them all and wouldn’t have been capable of such maturity when I was 19.”

Collectables success

In the year that auctioneer Chris Ewbank died, the Surrey company he established posted sales of £5.02m, up 13% on 2022.

A very traditional lot provided Ewbank’s with its best-selling single entry: JMW Turner’s early watercolour of the Finchley home of his patron Charles Monro sold for £26,000. However, it is in some of the ‘new’ collecting disciplines that the firm has made its mark.

Senior partner Andrew Ewbank said: “We are expanding our offer across collectables and launching a new comics department with regular sales in 2024. We also recognise that there is a huge and largely untapped audience of potential buyers out there who are not used to auctions, so the way we market sales is becoming increasingly important.

“I believe we can serve sellers better if we think more carefully about how to present sales from the buyer’s point of view, using language they can relate to more easily rather than the traditional auction terms we have used for decades.”

Adapt to the market

Repackaging of less fashionable sale categories into formats with potentially greater appeal is part and parcel of the 21st century auction room environment.

Special Auction Services in Newbury hammered around £4.5m – an uplift of 10% over previous years.

Director Neil Shuttleworth said it is only through specialisation that the firm has prospered. “The market has changed, and we have had to adapt. Certainly Brexit, Covid and the state of the country’s finances has had a big impact. The higher end is healthy but the lower end more difficult. Sales in the traditional markets do need to be carefully curated.”

Shuttleworth pointed to two industry-wide challenges: meeting changing customer expectations and the difficulties of recruitment.

“People’s buying habits have changed. It is expected that items can be online, packed and sent in a short timescale but this presents the smaller auction houses with difficulties. Finding new members of staff to suit available job roles is also tough.”

Five years of growth

Sir Gareth Edwards’ 1973 Barbarians jersey from ‘the greatest match’ versus New Zealand sold for £240,000 at Rogers Jones in February – a record for a rugby jersey.

Welsh auction house Rogers Jones has enjoyed year-on-year growth for the last five years. The firm posted record figures of £3.82m in 2023 helped by the £240,000 sale in February of Sir Gareth Edwards’ 1973 Barbarians jersey from ‘the greatest match’ versus New Zealand.

Welsh art and antiques remain a staple of turnover in both Cardiff and Colwyn Bay.

“I am pleased to say that the market for Welsh art is as buoyant as it ever was (we had a 92% success rate with pictures by Kyffin Williams) and I’m encouraged by new younger blood bidding at our Welsh sales”, said Ben Rogers Jones.

He added that the firm has expansion plans in 2024 that will “ensure that everyone located in Wales has easy access to a Rogers Jones venue” and “tell the Rogers Jones story to more potential clients in the English border counties and London”.

Expansion plans

Another significant ‘mover’ in 2023 was East Anglian firm Bishop & Miller, now based in both Stowmarket and Glandford, near Holt. Sales across the calendar year were £3.7m, a 54% increase year on year from 2022 (£2.4m).

The firm’s penetration into the oak and vernacular market has been particularly noteworthy: last year’s single-owner sales included the Chapman collection of pewter and early metalwork, furnishings from Eyton Court and the Beedham collection.

An Elizabeth I bronze pint exchequer measure dated 1601 from the collection of Tony Chapman sold for £30,000 at Bishop & Miller in February.

“We have seen growth across multiple sectors in our business”, said Oliver Miller. “It has been fuelled by single-owner collections which are really catching the imagination of our buyers and the remote bidding that is reducing resistance to completing sales.

“We have several single-owner collections coming up (including a major collection that we will announce in the spring) and are also embarking on a building revamp to give a gallery feel to our Suffolk rooms. The work is scheduled to begin in August. The Norfolk branch is also looking to expand. The rapid growth of the business in the county since we launched means more space is required.”

Cartier house record

While declining to provide an overall figure, Maidenhead’s Dawsons said it has experienced “another year of growth across all departments with overall hammer up 12%. The appetite of buyers, for fresh-to-market items remained strong.”

The 35 sales (all of them ‘live online’ events held without bidders in the saleroom) included a new house record of £340,000 for a Cartier Kashmir sapphire flower brooch.

Owner and executive chairman Ben Haynes told ATG that Aubrey Dawson had left in November and is no longer associated with the business. Pete Liggins, who has worked with Dawsons as commercial director for four years, has taken over the managing directorship.

Regular contributions

Staffordshire auction house Richard Winterton posted 2023 sales of £3.45m – a record turnover for the firm and an increase on the previous year of over £600,000.

The extra business came solely from general weekly auctions at the Lichfield Auction Centre, Fradley, and the monthly collectors’ sales at Tamworth.

The firm added six new members of staff to the team in 2023.

Building up

Helped by a house record of £48,000 for Winifred Nicholson’s Blue Hyacinths in a Winter Landscape, the sales at 1818 Auctioneers in Cumbria were £1.78m, a rise of 5% on 2022.

The firm, which now conducts all its sales as timed online auctions, said its turnover has increased three-fold since it moved to its current site at Milnthorpe 10 years ago. Plans for 2024 include an extra two-storey saleroom building.

This article presents a selection of annual hammer totals as reported by UK and Irish auction houses to ATG. It does not represent a comprehensive survey and the totals reported to us are not audited by us. Hammer totals for London firms with a particular specialty in coins and medals will be reported in ATG No 2630. Any totals we receive after our print deadline will be added to the online version of this article.