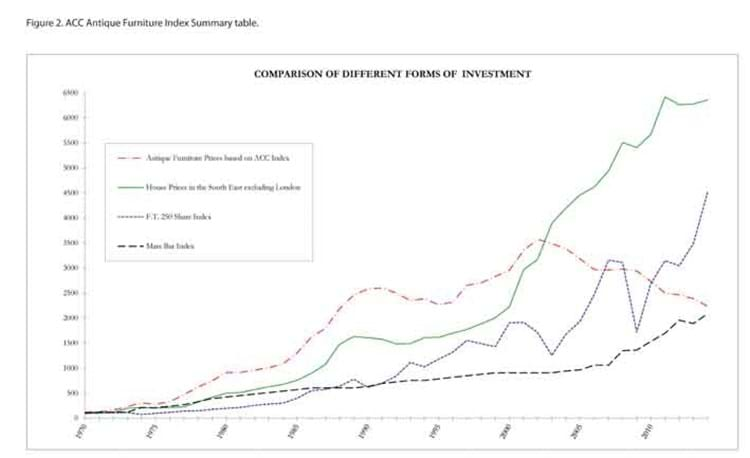

As a whole the index, based on a blend of retail and auction prices for 1400 typical (rather than exceptional) items pictured in John Andrews' book British Antique Furniture, fell by 6% last year. Set at 100 when Mr Andrews began the project in 1968, the Index reached a high of 3575 in 2002, but now stands at 2238, down 62% from its peak and a level it last saw in the late 1980s.

The past decade has seen the AFI in steady decline, including record falls of 7% in 2009 and 8% in 2010 - a sustained fall in contrast to the gains seen on the stock exchange or the housing market.

According to the AFI, antique furniture - a marketplace that rode high on the wave of its investment potential in the 1970s and '80s - is struggling to keep pace with inflation (recorded here as the Mars Bar Index) across 45 years.

In 2013 falls were recorded in all seven of the major categories from which the Index is derived.

The categories most associated with the decline in formal dining, Late Mahogany (-7%) and Regency (-8%), show few signs of returning to form, while falling demand for dressers and coffers meant Oak (-6%) and Country (-7%) again showed the new-found vulnerability that has marked them among the biggest losers in recent years.

Auction Prices

Large amounts of Victorian and Edwardian mahogany furniture continues to be discarded cheaply at auction - "there is a widening disparity between retail prices and those being noted at auction," observed Mr Andrews - and the separate Victorian & Edwardian index, started in 1973 and once the recipient of spectacular gains, registered a 6% drop.

Some forms remain strong, such as the upholstered tub chairs popular with interior decorators, while other standard late 19th and early 20th century pieces, such as the davenport, the work table and the credenza still languish among the unfashionable. Anything too bulky for the modern interior meets negligible demand.

Early Mahogany, a category based on good-quality, middle-range pieces made between 1730 and 1760, during which period the reputation of English furniture was established, fell 4% in 2013. This wipes out the 3% gains seen the previous year when the words 'green shoots' were used amid suggestions of an imminent change in fortunes.

Buying Base

The buying base has doubtless contracted, observes Mr Andrews.

"In these circumstances the acquisition of antique furniture is becoming concentrated into a smaller and keener body of enthusiasts rather than being a staple source of general domestic furnishing," he said.

Like dealers and auctioneers across the country, he continues to push the message that antique furniture is both better quality and better value than modern alternatives - and points out the cyclical nature of fashion-led markets.

"In the 1960s it was said that the price of oak furniture had not yet regained the level at which it had sold in the 1930s. Those who like antique furniture purely for itself are in the happy position of being able to acquire it now at prices in many cases of 20 years ago. There is a sunny side to everything."

A fuller analysis of the numbers is published in the February edition of Antique Collectors' Club magazine Antique Collecting.