The answer could be: put it in a business where it forms an essential part of their trade, and argue with HMRC that it is "plant", so that when you come to dispose of it later, it is protected from a levy under the Taxation of Chargeable Gains Act 1992.

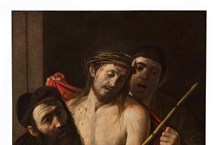

The legitimacy of this position was at the heart of the debate in The Executors of Lord Howard of Henderskelfe (Deceased) v The Commissioner of Her Majesty's Revenue and Customs, an appeal hearing that had to decide whether Sir Joshua Reynolds' masterpiece, the late 18th century oil portrait of Omai, should be subject to a large tax bill or not.

In essence, the executors of the estate had to prove that the painting had been an essential part of the trade of Castle Howard Estate Ltd, the company which owned the castle, that the painting fitted the definition of "plant" and that the painting retained this status when disposed of by Lord Howard's estate. If so, it then became CGT exempt.

ATG legal columnist Milton Silverman of law firm Streathers and his colleague, Tax Trusts and Heritage partner Michael Lindley, have assessed the case on page 56 of this week's issue.