Introduction

Nestled between its two new fairs in New York, TEFAF returns to its roots in Holland this month. Here we begin ATG’s special Maastricht preview by examining the challenges and hopes carried by this year’s event

IN the unpredictable times in which we live, at least some things are certain. From March 10-19 the European Fine Art Fair, better known as TEFAF, will stage its 30th edition, turning the small city of Maastricht into the mecca of the art world for a short period.

Some 75,000 visitors will flood into the venue’s carpeted halls to see objets d’art brought by more than 270 exhibitors from around the world.

Oh, and in all likelihood sales will be made – to private collectors, museum curators and between the dealers themselves.

This much we know. With the current volatility of global economics and politics, small wonder that TEFAF chief executive Patrick Van Maris is quick to reassure ATG that visitors and exhibitors will witness “no big dramatic changes” to this year’s event. Its reputation as the world’s top tier event – “It’s like the Met museum, but everything is for sale,” as one dealer memorably put it – is fiercely protected.

The dealer-organised fair has stuck largely to its traditional heartland of Old Master paintings and antiques. While there has been a welcome injection of new blood – nearly 20 dealers have joined either for the first time or after extended breaks while around the same number have left – there are no additions that suggest a significant switch in tack to Contemporary.

The run-up to TEFAF Maastricht 2017 has, however, featured some drama, at least by the Dutch organisation’s sedate standards.

Renowned art economist Dr Clare McAndrew, author of TEFAF’s annual Art Market Report, defected to the Art Basel fair group in 2016, as the competition to produce the definitive set of art market statistics hotted up.

The move was a blow to TEFAF but the study’s new helmswoman is another respected art market academic, Rachel Pownall, professor of finance at Maastricht University School, a position partfunded by TEFAF. Pownall promises to focus on trends as well as market size in the 2017 report, published on March 6, ahead of the fair.

More seismic than McAndrew’s exit was the expansion in 2016 of TEFAF into the US, with the launch of two new fairs in New York. In a heavily marketed move, TEFAF New York Fall debuted in October to focus on pre-20th century, while TEFAF New York Spring (May 4–9, 2017) marks a period leap into Modern and Contemporary art and design.

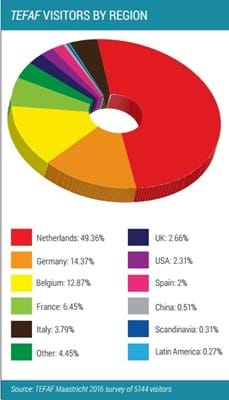

Both fairs are deliberately smaller than the Maastricht flagship, with around 90 exhibitors apiece. If anything, the advent of TEFAF in the US underlines the ‘Dutchness’ of the Maastricht fair (see page 20), with visitors from The Netherlands comprising half the attendees.

But while the New York move has not dented US dealer demand for stands at Maastricht (see table, top right), regular exhibitors were split when asked to predict its impact on visitor numbers from across the pond.

Old Master dealer Derek Johns and a TEFAF stalwart of 25 years, views the New York venture as risky. “The way I see it, New York may have weakened the mothership. We will have to wait and see. There will still be diehard buyers coming to Maastricht but other collectors or museums may just want to go to New York now.”

TEFAF’s board factored in this possibility, and, after all, US visitors comprised a small proportion of Maastricht’s footfall last year (see graph, bottom right). That said, other exhibitors hope for a bonus from the growing global fame of TEFAF’s brand. “The first TEFAF New York helped promote TEFAF’s presence overall,” says Jonathan Green of gallery Richard Green (pictured below left). Green is a TEFAF board member and supported expansion to the US. “The strong dollar too will encourage American buyers to come to Maastricht.”

Other global art market issues, such as authenticity and ivory, remain a concern for dealers. TEFAF prides itself on the fair’s volunteer army of top-drawer vetters that has the annual burden of keeping Maastricht free of fakes and poor cataloguing (page 32).

The vetting at TEFAF is “the most stringent in the world,” says Johnny Van Haeften, who may bow out of TEFAF this year (page 24). “New buyers from China and South America, in particular, need that reassurance.”

Many eyes will be scanning stands for any diminution in ivory’s presence, after a year of regulatory clampdowns. Exhibitor Martin Levy, of H Blairman & Sons, acknowledges that US buyers will be acutely aware they cannot take home ivory from Maastricht but still hopes dealers will “show objects made with ivory with the same passion they did in the past”.

With 2017’s fair yet to start, Van Maris is already contemplating the next 12 months, promising a more user-friendly website and other initiatives. And yet more global expansion?

“We will continue to look at emerging markets and shifts in tastes, but we are reasonably cautious and do things step by step,” he says. It took TEFAF all of 30 years to get to New York, but Van Maris vows “this is not the end of our expansion”. Exhibitors will be keen that such ambitions do not dilute Maastricht’s ‘world’s greatest art fair’ label, whatever happens in New York and beyond.

On this, Levy argues that the European fair’s somewhat remote location is a core advantage over other events. “The art world descends on this little town that dedicates itself to the TEFAF fair,” he says. “In New York and London, there are far more distractions. The calm and concentration of Maastricht makes it stand out.”

Additional reporting by Frances Allitt, Laura Chesters, Anne Crane and Roland Arkell