Following five consecutive years of growth, Christie's International reported a 5% decline in global sales to £4.8bn ($7.4bn) - of which £4.3bn were auction sales (up 2% in sterling terms but down 4% in dollars) and £554.9m (down 43%) were private sales.

It was the privately owned company's second-highest aggregate in their history, although down from £5.1bn as the Contemporary art market peaked in 2014.

Publicly traded Sotheby's reported sales of $6.7bn, down 2%, with private sales of $673m, up 8% from 2014. More detailed trading figures will be issued later this month.

Trophy Lots

Now in their 250th anniversary year, Christie's attributed the dramatic fall in private sales to the inclusion of a handful of trophy lots at auction in the hope of achieving "a breakout price".

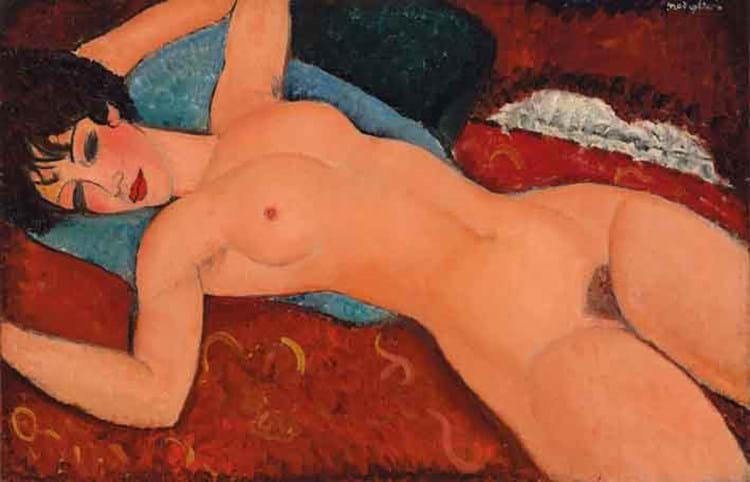

They included Picasso's Les Femmes d'Alger (Version O), sold in May for $179.4m (the highest auction price for any artwork), and Modigliani's Nu Couche, sold for $170.4m to China's Long Museum in November. These works contributed handsomely to the Impressionist and Modern category where Christie's said sales had risen by 57% to £1.3bn.

However, a 14% fall in Contemporary art (to £1.5bn) accounted for much of the shortfall alongside lacklustre sales for Old Masters, 19th century paintings and Russian art (down 37% to £154.9m) and luxury goods such as wine, watches and jewellery (down 13% at £493.4m).

Although the froth has gone from the Asian art market, global sales here grew to £478.6m (up 9%).

As Christie's seek to put major lots in front of its biggest audience, sales in New York grew 19% to £2.4bn last year and there were pockets of growth in Hong Kong (5%), Mumbai (32%) and Paris (15%). However, as total sales in Europe fell 18% to £1.4m, one can conclude it was a less-than-vintage year for Christie's two London salerooms.

Sotheby's Figures

Sotheby's, who posted a fourth-quarter loss of between $12m-19m, said on January 22 that sales of Impressionist and Modern art also grew (up 21% to about $1.7bn) with Contemporary sales climbing 8% to $1.8bn.

CEO Tad Smith, who took the helm in March, attributed the losses to "a lower level of various-owner auction sales, as well as charges related to the Taubman collection" that also saw commission margins squeezed to 12.8% (down a percentage point on 2014).

The remainder of their former owner's collection (guaranteed by Sotheby's for over $500m) was sold last week in New York, realising a premium-inclusive $24.1m, close to the low estimate.

The big two are expected to channel resources into what they term the middle market: works priced between £25,000 and £1m. Jussi Pylkkänen, Christie's global president, says their strategy this year is to reinvigorate sales in this core market, while Smith has highlighted this as an area of focus in 2016.

The top of the market will face its first major test of 2016 in this month's London series where Sotheby's and Christie's have worked to bring estimates down.

As the global stock market and low oil price raise concern about the art market in 2016, Smith said Sotheby's could cope with a downturn - "even if the art market blows".